View this testimony as a PDF here.

Every Texan (formerly CPPP) appreciates the opportunity to comment on HB 633 by Representative James Frank.

The Benedictine Sisters of Boerne, Texas, founded Every Texan (formerly CPPP) in 1985 to advance public policy solutions for expanding access to health care. We became an independent, tax-exempt organization in 1999. Today, we prioritize policies that will measurably improve equity in and access to health care, food security, education, and financial security. We are based in Austin, Texas, and work statewide.

Every Texan was supportive of the provision included in the filed version of HB 633, which would cap hospital charges that could lawfully be billed to uninsured Texans at a rate lower than the “rack rates” that are not paid by either commercial insurers or Medicare. It appears that the Committee Substitute also includes provisions affecting uninsured consumers, and we are testifying “on” the bill and its substitute.

Every Texan hopes that the filing of this bill and others like it may signal Legislative interest in working across the aisle to address the tremendous problem of medical debt for Texas’ low-and moderate-income families. We focus in particular on the flip side of the negative health impact when families skip medical care due to costs, i.e. when families access medically necessary care that they simply cannot afford by taking on debt they cannot support. Texas families need action from state leaders both to give relief from medical debt and to open up access to health care. Without direct attention to reducing working families’ medical debt, generations of family asset-building work can be wiped away, and new generations may be unable to move up and ahead.

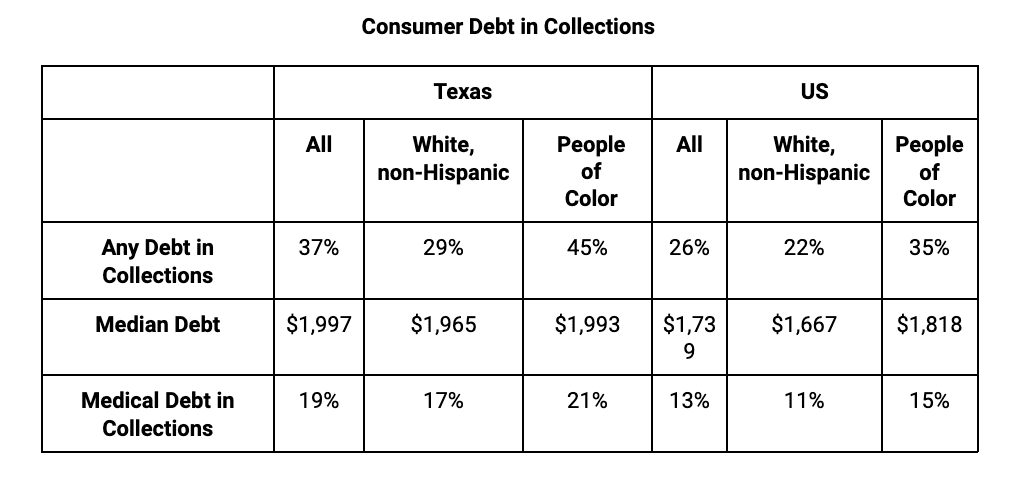

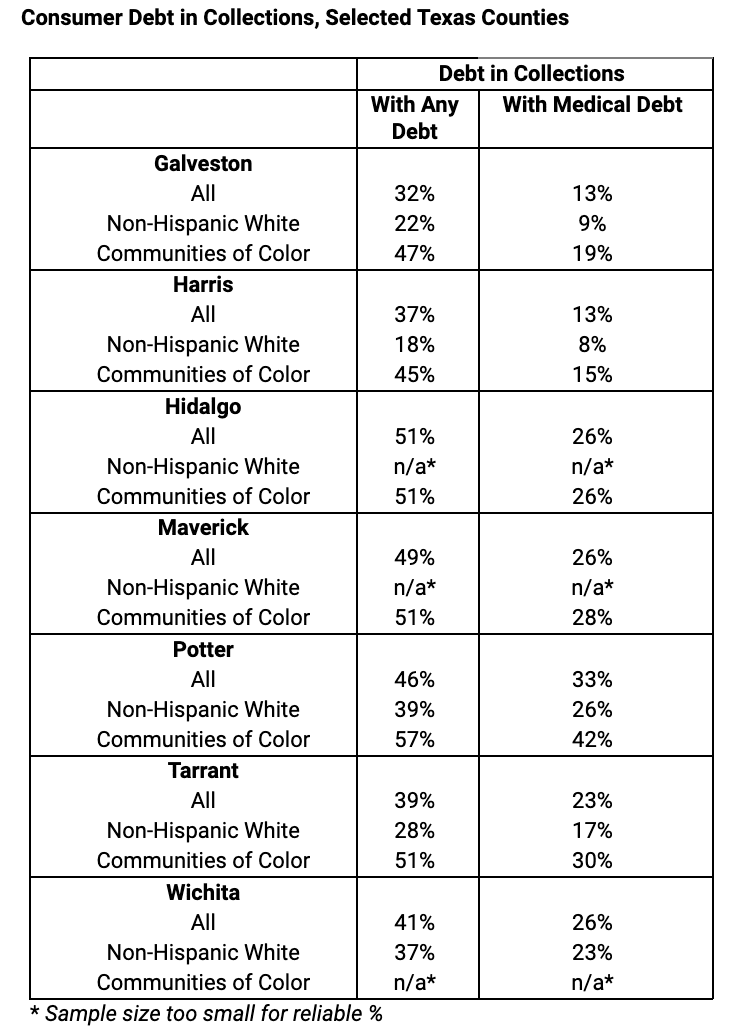

Texas is a national epicenter of medical debt. Texas has one of the highest U.S. rates of households with medical debt in collections. Of the nation’s 20 most populous counties, three Texas counties top the list with the highest concentrations of medical debt: Tarrant County (Fort Worth), Dallas County (Dallas), and Bexar County (San Antonio), with Harris County (Houston) close behind in sixth place (Urban Institute, Debt in America, 2022).

Texans of color are disproportionately burdened by medical debt. In Tarrant County, for example, 17% of households in white communities have medical debt in collections compared to 30% of households in communities of color. Overall, one in three Texans report they have had problems paying medical bills in the last year, yet significantly more Hispanic Texans (41%) and Black Texans (38%) are likely to have trouble paying medical bills than white Texans (32%) (Episcopal Health Foundation, Texas Health Tracking Survey, 2022). The racial and ethnic disparities in medical debt perpetuate inequities in access to housing, financial stability, educational attainment, access to health care, access to credit, and overall opportunity to move ahead and prosper.

Thank you for considering our position.

For additional information, contact Anne Dunkleberg, Senior Fellow at dunkleberg@everytexan.org.

Source: Urban Institute, Debt in America, 2022 – February 2022 credit bureau data, US Census Bureau’s American Community Survey (ACS) 2019; (for areas with smaller populations and for metrics that incorporate zip code–level information, ACS five-year estimates (2015–19)