Budget & Taxes

Texas is fortunate to have a thriving economy, and we can afford to make the investments needed to ensure that every Texan can share in the state’s prosperity.

Texas needs a budget and tax system that is fair, adequate, and responsive to our state’s growing population and needs. The ability to invest in public services that will build a more prosperous future for every Texan relies on the ability of our tax system to support those services.

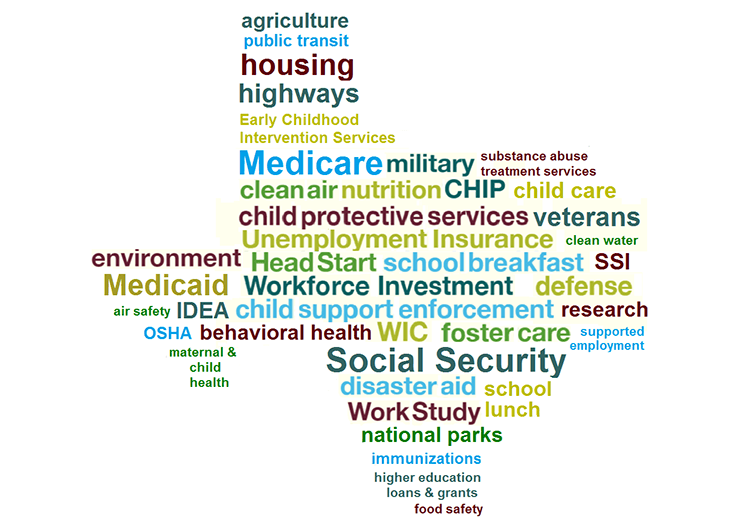

Federal Budget & Taxes

Where the Money Comes From

Where the Money Goes

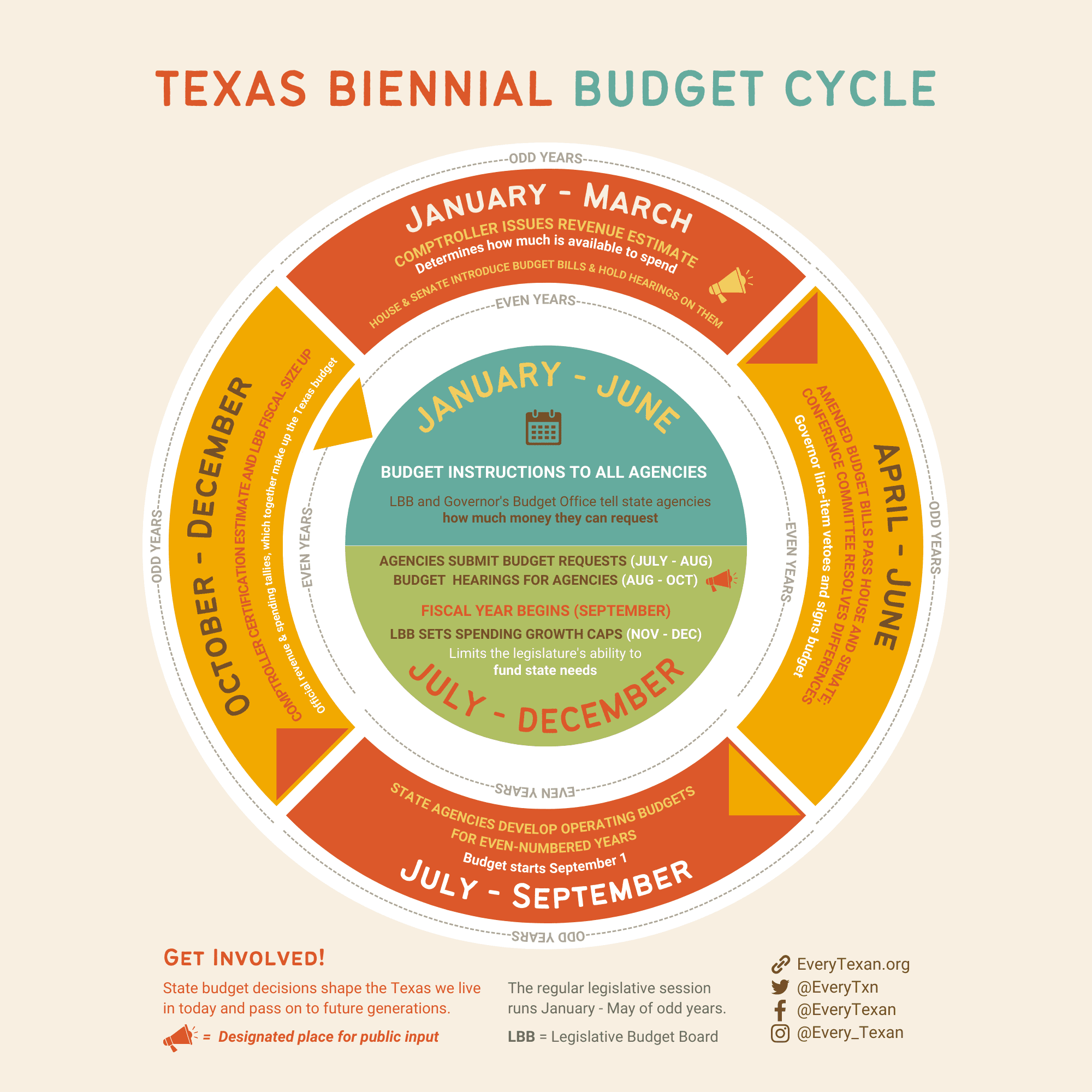

Texas Biennial Budget Cycle

The Texas budget process begins during the year prior to each regular session of the state’s Legislature, which are held in odd-numbered years. Each state agency prepares a detailed legislative appropriations request (LAR) under the guidelines of the state’s Legislative Budget Board (LBB).

State budget decisions shape the Texas we live in today and pass on to future generations. Be sure to get involved. Your voice matters!

Related Resources

Testimony to Senate Finance Committee on Property Tax Cuts (Video)

State of Working Texans 2024

Texas Is the Tale of Two Economies

The 2024-25 Texas Budget: The Big Picture

Proposition 3 Will Maintain Texas’ Extreme Wealth Inequality

A Look at the 2024-2025 Texas Budget

Your Support Makes a Difference

We believe Texas can be the best state in the United States, and our public policy work is an indispensable part of getting there. Your support improves equity in health care, food security, education, and financial stability.