The Texas Family Act (HB 2604/SB 1079) will provide 12 weeks of paid parental leave to full-time employees at the birth or adoption of a child. If the act passes, Every Texan estimates approximately 144,000 new parents will receive a percentage of their weekly salary as a wage replacement from the Texas Family Fund, capped at $1,000.

In Texas, billion-dollar corporations continue to say that the unregulated market will provide everything workers and their families need to prosper, but that simply is not true when it comes to critical paid leave benefits. 74% of Texas workers do not have access to any form of paid medical leave and 64% do not have access to unpaid family medical leave. This reality leaves both families and employers vulnerable during times when employees may need to care for a newborn baby or recently adopted child. Texan families are expected to give birth to approximately 373,000 new babies annually. During the pandemic, over 10 million Americans cited caregiving as the reason for leaving their jobs and the exodus of particularly women from the workforce put our state economies in a precarious situation. Furthermore, childcare costs in the US are unaffordable for 63% of working and middle-class families. Most childcare facilities will not accept infants less than six weeks old — forcing families to choose between their livelihood and caring for a newborn baby.

The lack of paid parental leave in Texas also leaves small businesses vulnerable. Frequently, small businesses cannot afford to fully cover an employee’s wages while they care for a newborn baby. The Texas Family Fund will give small businesses an opportunity to provide their valued workers with a solution at an affordable rate.

Paid parental leave benefits small businesses.

The ability to offer paid parental leave to employees provides numerous benefits to small businesses:

- Paid parental leave improves staff retention;

- A state-level paid parental leave gives small businesses a competitive market advantage with large corporations that may already offer some form of paid leave;

- Overall, 89% of employers report a positive or no change in productivity levels;

- Paid parental leave keeps women in the workforce, potentially adding an additional $19.1 billion dollars in wages to our state economy;

Majority of small businesses already support paid family and medical leave policies. 70% of small business owners support a national or state-paid leave program.

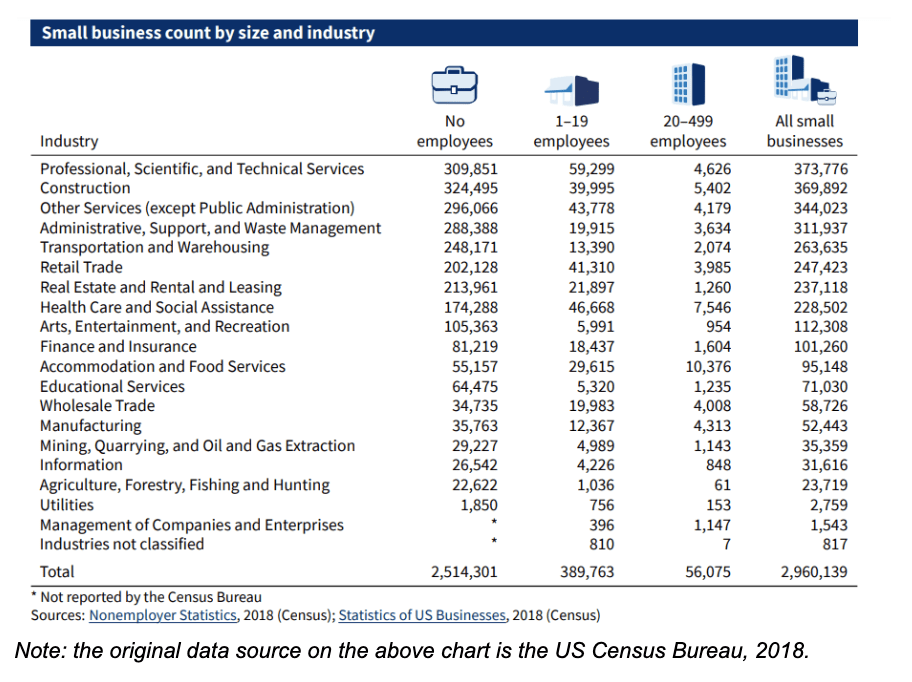

How large is the Texan small business community and how many Texans are employed by small businesses?

There are 3 million registered small businesses in Texas that employ approximately 4.9 million Texans or approximately 45% of the state’s workers. According to the Small Businesses Administration of Texas of the roughly 3 million small businesses, 2.5 million or 85% do not have any employees. Approximately 389,000 small businesses employ less than 19 employees; this means 98 % of Texas’ small businesses employ less than 19 employees.

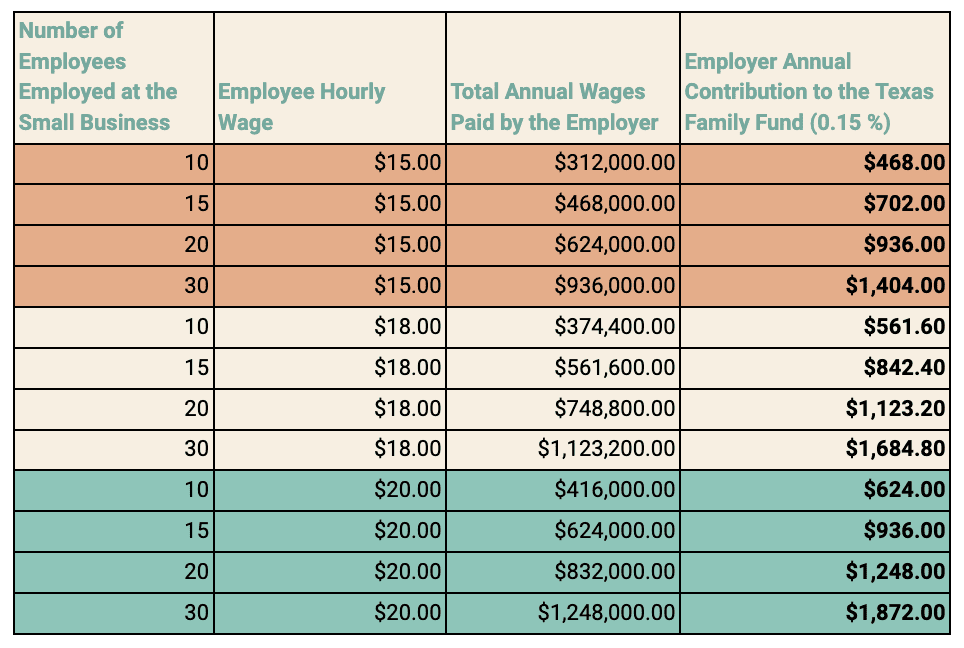

The Texas Family Fund employer contribution is 0.15% of the small business’ total annual wages. Each small business’ Texas Family Fund contribution will depend on how much the employer paid in total annual wages. The formula to calculate an employer’s Texas Family Fund contribution is:

.0015 x total annual wages paid by the employer = Texas Family Fund contribution

Example: an employer pays out a total of $500,000 in wages to their employees

.0015 x $500,000= $750 total annual contribution

According to the US Small Business Administration, 85% of small businesses in Texas have no employees; these businesses will not make a contribution to the Texas Family Fund. Another 13% of small businesses have less than 19 employees, reflecting that most small businesses in Texas are, in fact, smaller-scale operations.

The chart below provides example scenarios of how much a small business may contribute to the Texas Family Fund based on the number of employees and total annual wages paid:

The Texas Family Fund is an affordable and accessible benefit for small businesses to offer their workers.

Most small businesses cannot afford a private, short-term disability insurance policy to cover paid parental leave for their employees. Insurance premiums are often designed for large corporations with large groups, making such a plan prohibitive for small businesses. Private insurance is costly and in most cases, not an option for a family-owned small business.

The Texas Family Fund will provide small businesses with a paid parental leave benefit that will improve the retention of valuable employees at a cost that is proportional to their specific business size. By design, the Texas Family Fund meets the unique needs of the small business community because the benefit cost is proportional to the business’ wages paid. In most cases, small businesses will pay less into the Texas Family Fund than the cost to have a single employee on paid parental leave. For example, Every Texan estimates that the average Texan worker will receive a weekly wage replacement of approximately $670 per week; at 12 weeks that would be a total wage replacement of $8,040.

This is about our shared values.

Texans of all backgrounds value our children, families, and hard work. Texans can show the rest of the nation that these values do not have to conflict with one another. Nurturing, healthy families and small businesses go together. We can make Texas a state that works for us all.