Texas House Committee on Insurance

via email to Committee Clerk Sergio Cavazos at Sergio.Cavazos_HC@house.texas.gov

Dear Chairman Lucio and Members of the Committee:

Every Texan (formerly Center for Public Policy Priorities), appreciates the opportunity to submit information in response to your RFI regarding Senate Bill 1940:

Interim Charge 1: [Monitor] SB 1940, which extends to August 31, 2021, TDI’s authority to revise and administer the temporary health insurance risk pool to the extent federal funds are available. Study ways to foster a competitive market and reduce the uninsured rate, including by exploring flexibility available through federal waivers.

At Every Texan, we envision a Texas where people of all backgrounds can contribute to and share in the prosperity of our state. Texas faces long-standing challenges to optimal health, including the nation’s highest uninsured rates, and steep financial and systemic barriers for those who have insurance. We work to improve public policies to make affordable, comprehensive care a reality for every Texan.

If Texas pursues a 1332 waiver, as is authorized temporarily in SB 1940, it should do so with the aim of covering more Texans with quality, affordable health insurance and only as part of a comprehensive state approach to significantly reduce the state’s high uninsured rate. A 1332 waiver alone will be insufficient to address Texas’ substantial uninsured challenge.

Texas has the highest uninsured rate in the nation and it’s getting worse. Even before staggering job losses due to COVID-19, 5 million Texans (18%) were uninsured.[i] In just March and April, 1.6 million Texans lost job-based health insurance because of COVID-related job losses.[ii] Only half of Texans who lose job-based health insurance during the pandemic will find other coverage; the other half will become uninsured.[iii]

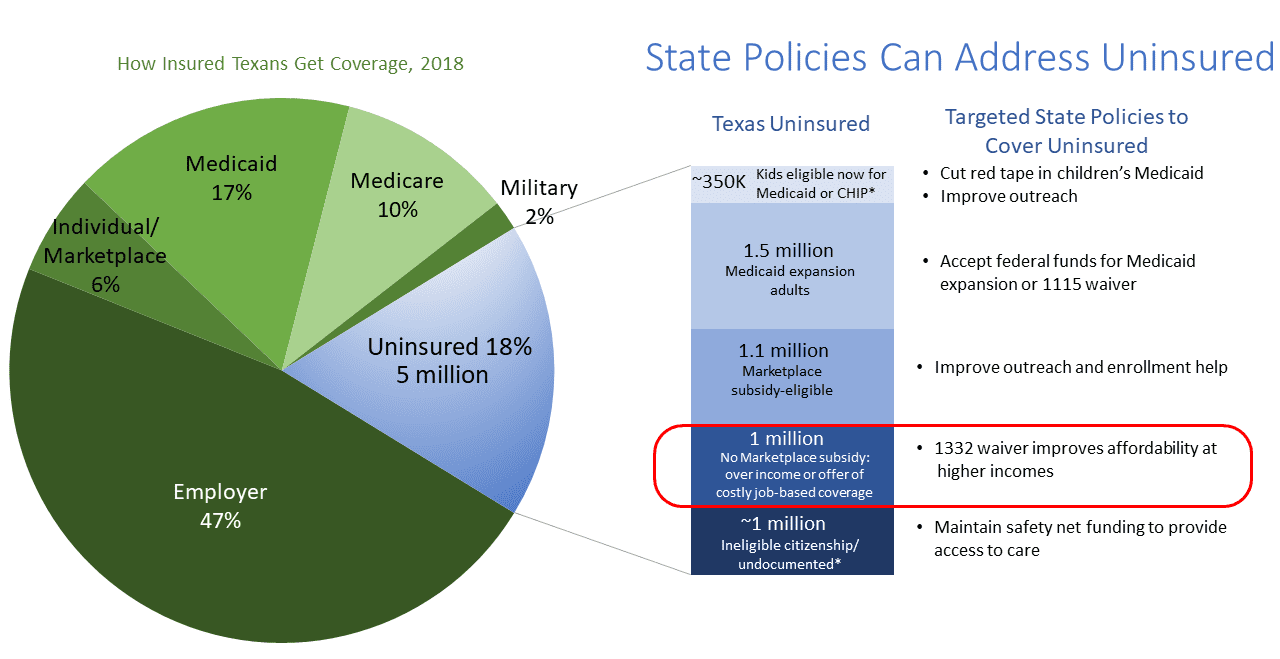

The vast majority of uninsured Texans are U.S. citizens; have low or moderate incomes; and work or are in a family with a worker, but are not offered or cannot afford health insurance with a low-wage job.[iv] Texas policymakers can use a range of available tools to lower Texas’ high uninsured rate and reduce the burden it places on families, communities, and our health care system (see Figure 1).

Medicaid expansion must be part of Texas’ approach to reducing the uninsured

Along with any 1332 waiver, Texas must accept federal funding to expand Medicaid coverage to Texas adults below 138% of the federal poverty level, which includes low-wage working parents and adults caring for a disabled family member.[v] A 1332 waiver cannot extend coverage to working poor adults in the “coverage gap” who are excluded from Texas Medicaid today, but earn too little to get Marketplace subsidies under federal law.[vi] Federal funding to cover working poor adults can only be accessed through Medicaid expansion or a Medicaid 1115 waiver. All 14 states with approved 1332 “reinsurance” waivers today have already closed their Medicaid coverage gap, ensuring that uninsured adults in low-wage jobs that do not offer coverage have access to Medicaid.[vii]

1332 reinsurance waivers reduce premiums for higher-income individuals and generally produce small coverage gains

Today, 14 states have federally-approved 1332 waivers that establish a state-administered reinsurance program.[viii] Reinsurance programs provide payments to individual-market health insurers that help offset the costs of enrollees with high health care spending. Insurers, in turn, reduce their premiums because they face less risk from high-cost enrollees.

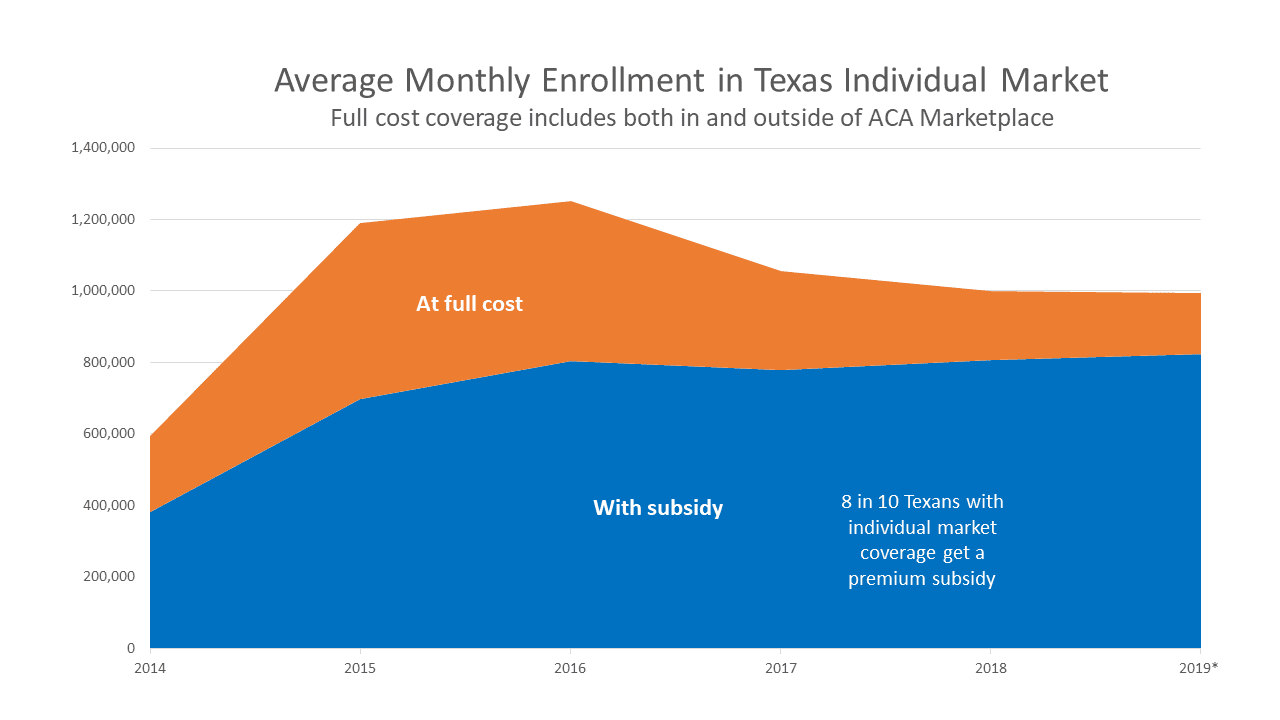

Reinsurance reduces the price of full-cost premiums for people who do not qualify for Marketplace subsidies. It does not further reduce premiums for people who have Marketplace subsidies.[ix] This primarily benefits higher-income individuals (with incomes over 400% of the federal poverty level or about $51,000/year for an individual and $105,000/year for a family of four in 2020) and others ineligible for subsidies. Unsubsidized enrollment in the Texas individual market has declined since 2016, while subsidized enrollment has increased (see Figure 2).

1332 reinsurance waivers in other states have reduced full-cost, individual-market premiums by 17% on average.[x] These states generally anticipate a relatively small increase in coverage to result. Most states that have established a 1332 reinsurance program estimate that coverage in the individual insurance market would increase from 1-3% (see Figure 3).[xi] A recent market analysis estimates that 1.3 million Texans have individual market coverage today.[xii] Growth of 1-3% in Texas would translate to an additional 13,000 – 39,000 people covered.

Reducing premiums for higher-income individuals to cover tens of thousands of additional Texans is a worthy goal that lawmakers should pursue, but not without also ensuring an affordable coverage option for 1.5 million uninsured, low-income Texans[xiii] who would be eligible under Medicaid expansion.

State financing of 1332 reinsurance waivers

Reinsurance payments come from federal “pass-through” funding available through 1332 waivers, combined with a state share. Among states with 1332 reinsurance programs, the state share of program costs ranges from 3% to 56%, with states financing about one-third of the program’s costs, on average.[xiv]

Most states finance their state share through an assessment on health insurers, though a few states use other methods including General Revenue, provider assessments, and penalties from state-level individual coverage mandates (see Figure 4).

Keep what’s working: affordable and comprehensive coverage

The Affordable Care Act (ACA) greatly expanded access to individual market coverage by creating sliding-scale subsidies for people with incomes from 100-400% of the federal poverty level and prohibiting insurers from denying coverage or charging more because of pre-existing conditions. Under the ACA, coverage in the individual market has grown and Texas has seen historic declines in its uninsured rate (though Texas still has the highest uninsured rate and population).[xv] More than 1 million Texans have enrolled in 2020 Marketplace coverage, and 9-in-10 of them receive a federally funded subsidy to make monthly premiums affordable.[xvi] In addition, 6-in-10 have plans with reduced out-of-pocket costs, like deductibles and copays, to improve access to care. Maintaining adequate financial assistance is critical to ensure that both health coverage and health care are affordable for Texans with lower incomes.

Today, individual market coverage provides comprehensive benefits and strong protections for people with pre-existing conditions. Plans cover Essential Health Benefits (which includes benefits for maternity, mental health and substance use, prescription drugs, and more) with no annual or lifetime limits, and insurers cannot deny coverage or charge more due to pre-existing conditions.

Any Texas 1332 waiver must immediately result in more Texans getting enrolled in coverage that is as affordable (premiums and out-of-pocket costs), with benefits that are as comprehensive, and with pre-existing condition protections that are as strong as in Texas’ ACA-compliant market today. The 14 states with approved reinsurance waivers have achieved this outcome. Should Texas want to build upon reinsurance in a 1332 waiver, it should consider ways to further address affordability challenges, particularly for consumers with low and moderate incomes.[xvii]

Keep what’s working: access to unbiased and centralized consumer information and community-based consumer assistance

Today, HealthCare.gov gives clear, comparable, and unbiased information to consumers on their health plan options and supports enrollment assistance through agents, community-based organizations, community health centers, and hospitals. It also provides a “no-wrong-door” approach that ensures Marketplace applicants who are Medicaid- or CHIP-eligible get the correct coverage. On top of this, the federal Marketplace already supports direct enrollment through third-party web-brokers and insurers, so that consumers who want to, can enroll without going to HealthCare.gov.

Harms to avoid

1332 waivers must adhere to strong statutory “guardrails” that require coverage under a waiver to be just as affordable and comprehensive, to cover as many people, and to not increase federal costs. Though a few states have proposed waiver provisions that seek to erode current protections and would violate statutory guardrails, to date, CMS has not approved any of these.[xviii]

The following ideas could run afoul of statutory guardrails, would harm consumers, and should be avoided:

- Georgia has submitted an unprecedented 1332 proposal, pending with CMS, to eliminate enrollment through HealthCare.gov without creating a comparable state-based marketplace. This would force consumers to get information and enroll only through a fragmented system of private, third-party entities like web-brokers and insurers. Georgia’s proposal does not create any new channels to compare plans, enroll, and receive customer service – direct enrollment through private entities is already available today—rather it eliminates the most popular enrollment channel, HealthCare.gov. Forcing consumers to migrate from HealthCare.gov to other platforms would cause disruptions that are likely to decrease enrollment.[xix] Furthermore, third-party entities that perform direct enrollment today have been found to steer consumers toward substandard plans, fail to alert consumers they are eligible for Medicaid, and make it difficult to compare plans.[xx]

- A 1332 waiver should not promote coverage in short-term plans, other limited-benefit plans, or plans that exclude coverage of pre-existing conditions. These plans have lower premiums, but provide less coverage and pose risks both for consumers who buy them as well as consumers who remain in traditional, comprehensive coverage. Short-term plans siphon healthy individuals from the traditional individual market, driving up premiums for individuals who want or need comprehensive coverage or who would be denied by short-term plans, including Texans with cancer, diabetes, and mental health conditions. Short-term and other limited-benefit plans can also expose their enrolled patients to catastrophic costs in the event of an emergency or new diagnosis and add to uncompensated care burdens on providers.[xxi]

- A 1332 waiver should not recreate something similar to Texas’ pre-ACA high risk pool, which segregated sick individuals in a different rating pool with separate plans. Texas’ old high risk pool was not set up or funded in a way to make it a meaningful coverage option for many Texans. At its peak, the Texas high risk pool covered fewer than 30,000 Texans (back when Texas’ uninsured population was 6 million people), with premiums twice as high as the market rate, and a pre-existing condition waiting period for people without prior continuous coverage.[xxii] Texas legislators abolished the high risk pool in 2013 because more-affordable, guaranteed-issue ACA coverage replaced it.

Considerations for a state-based marketplace

Other states and advocates are closely watching Pennsylvania, which plans to switch from HealthCare.gov to a state-based marketplace, hopes to operate its marketplace at a lower cost, and intends to use the savings to fund the state’s 1332 waiver reinsurance program. Pennsylvania’s plan is innovative, but it also presents risks for consumers, as well as costs and challenges to the state. Savings projected at the beginning of a complex and lengthy project could fail to fully materialize. The state is still in the process of building and testing its IT infrastructure and developing consumer assistance functions needed to switch to a state-based marketplace.

Switching to a state-based marketplace is a complex undertaking. Texas should not do it as a means to save money, because the savings may not materialize. It also should not consider such a complicated undertaking if the result would be to merely replicate HealthCare.gov, which works pretty well today.[xxiii] There are, of course, many ways to build upon and improve HealthCare.gov, which could be done by the state or federal government. For changes to benefit marketplace consumers, regardless of whether they are made at the state or federal level, they should lead to increased comprehensive coverage, streamlined enrollment, an improved user experience, increased outreach and enrollment assistance, improved coordination between Medicaid and the Marketplace, and/or other improved consumer protections. Only if Texas has a clear intention and measureable goals to achieve several of these outcomes, not just cost savings, would a discussion about a state-based marketplace make sense.

Thank you for studying this important issue. We stand ready to help as you consider legislative options to ensure that every Texan has access to affordable and comprehensive health coverage.

Sincerely,

Stacey Pogue

Senior Policy Analyst, Every Texan

Appendix

Figure 1. Targeted state policy options to reduce Texas’ uninsured rate

Data on Texas coverage sources from U.S. Census Bureau, 2018 American Community Survey. Eligibility status among uninsured are estimates by Every Texan using the following data sources: Urban Instituted, Improvements in Uninsurance and Medicaid/CHIP Participation among Children and Parents Stalled in 2017, May 2019; Kaiser Family Foundation (KFF), The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid, January 2020; KFF, Distribution of Eligibility for ACA Health Coverage Among those Remaining Uninsured as of 2018; KFF, Distribution of Nonelderly Uninsured Individuals who are Ineligible for Financial Assistance due to Income, Offer of Employer Coverage, or Citizenship Status; US Census Bureau, 2018 American Community Survey; and Migration Policy Institute, Profile of the Unauthorized Population: Texas. *Categories subject to additional uncertainty related to undocumented population. Uninsured population excluded from all programs due to citizenship status could be larger.

Figure 2: Texas enrollment in full-cost individual market coverage has declined since 2016, while subsidized enrollment has increased slightly

Endnotes

[i] U.S. Census Bureau, 2018 American Community Survey

[ii] Kaiser Family Foundation, “Eligibility for ACA Health Coverage Following Job Loss,” May 13, 2020, https://www.kff.org/coronavirus-covid-19/issue-brief/eligibility-for-aca-health-coverage-following-job-loss/.

[iii] The Urban Institute, “How the COVID-19 Recession Could Affect Health Insurance Coverage,” May 2020, https://www.urban.org/sites/default/files/publication/102157/how-the-covid-19-recession-could-affect-health-insurance-coverage_0.pdf

[iv] Kaiser Family Foundation analysis of U.S. Census Bureau, 2018 American Community Survey, https://www.kff.org/state-category/health-coverage-uninsured/, and Every Texan analysis of U.S. Census Bureau, 2018 American Community Survey.

[v] 138% of the federal poverty level is $17,609/year for an individual in 2020.

[vi] Center of Budget and Policy Priorities, “Frequently Asked Questions about ACA Section 1332 Waivers and Medicaid,” Sept 2019, https://www.cbpp.org/research/health/frequently-asked-questions-about-aca-section-1332-waivers-and-medicaid

[vii] States with approved 1332 reinsurance waivers include: Alaska, Colorado, Delaware, Maine, Maryland, Minnesota, Montana, New Hampshire, New Jersey, North Dakota, Oregon, Pennsylvania, Rhode Island, and Wisconsin. All of these, except for Wisconsin, have expanded Medicaid. Wisconsin provides Medicaid eligibility up to the poverty level under a Medicaid waiver, so it has no coverage gap that would leave adults in poverty with no affordable options.

[viii] SHADAC, “State-Based Reinsurance Programs via 1332 State Innovation Waivers,” https://www.shadac.org/publications/resource-state-based-reinsurance-programs-1332-state-innovation-waivers.

[ix] Individuals with incomes from 100% – 400% of the federal poverty level can qualify for federally funded Marketplace subsidies (tax credits) which cap the cost of a benchmark Silver plan in the Marketplace at a share of the enrollee’s income. 9-in-10 Texas Marketplace enrollees receive tax credits to lower their premiums. The average full-price premiums in the Texas Marketplace is $532/month in 2020, while the average premium for a Texan with tax credits is $69/month.

[x] Avalere, State-Run Reinsurance Programs Reduce ACA Premiums by 16.9% on Average, October 2019, https://avalere.com/press-releases/state-run-reinsurance-programs-reduce-aca-premiums-by-16-9-on-average.

[xi] Estimated individual market growth from approved state 1332 waiver applications available at https://www.cms.gov/CCIIO/Programs-and-Initiatives/State-Innovation-Waivers/Section_1332_State_Innovation_Waivers-

[xii] Mark Farrah Associates, “Individual Health Insurance Enrollment Trends and Market Insights,” July 30, 2020, https://www.markfarrah.com/mfa-briefs/individual-health-insurance-enrollment-trends-and-market-insights/.

[xiii] Kaiser Family Foundation, Texas Medicaid expansion fact sheet, http://files.kff.org/attachment/fact-sheet-medicaid-expansion-TX.

[xiv] Avalere, State-Run Reinsurance Programs Reduce ACA Premiums by 16.9% on Average, October 2019, https://avalere.com/press-releases/state-run-reinsurance-programs-reduce-aca-premiums-by-16-9-on-average.

[xv] Every Texan analysis of U.S. Census Bureau 2018 American Community Survey, https://everytexan.org/wp/2019/09/10/red-flag-more-texans-uninsured-for-a-second-year/.

[xvi] CMS, Early 2020 Effectuated Enrollment Snapshot, July 23, 2020, https://www.cms.gov/CCIIO/Resources/Forms-Reports-and-Other-Resources/Downloads/Early-2020-2019-Effectuated-Enrollment-Report.pdf

[xvii] See policies discussed in Families USA, How States Can Use New Revenue to Lower Consumer Costs for Individual Health Insurance, https://familiesusa.org//var/www/stage/everytexan.org/html/wp-content/uploads/2020/03/COV_How-States-Individual-Market_Report_03-13-20a.pdf

[xviii] Georgia’s initial 1332 waiver application, much of which has been withdrawn by the state, proposed capping financial assistance and allowing waitlists for subsidized coverage, creating plans with much higher out-of-pocket costs, reducing benefits, and eliminating the Health Insurance Marketplace. Georgia’s modified 1332 waiver application that proposes eliminating the Health Insurance Marketplace is still pending with CMS. Iowa’s 1332 waiver application, withdrawn by the state, proposed eroding affordability protections for out-of-pocket costs for lower-income enrollees.

[xix] Tara Straw, “Tens of Thousands Could Lose Coverage Under Georgia’s 1332 Waiver Proposal,” Center on Budget and Policy Priorities, September 1, 2020, https://www.cbpp.org/research/health/tens-of-thousands-could-lose-coverage-under-georgias-1332-waiver-proposal

[xx] Tara Straw, “‘Direct Enrollment’ in Marketplace Coverage Lacks Protections for Consumers, Exposes Them to Harm,” Center on Budget and Policy Priorities, March 15, 2019, https://www.cbpp.org/research/health/direct-enrollment-in-marketplace-coverage-lacks-protections-for-consumers-exposes

[xxi] Milliman, “The impact of short-term limited-duration policy expansion on patients and the ACA individual market,” February 2020, https://www.lls.org/sites/default/files/National/USA/Pdf/STLD-Impact-Report-Final-Public.pdf.

[xxii] Every Texan, “Remembering the Bad Old Days of High-Risk Pools,” May 1, 2017, https://everytexan.org/wp/2017/05/01/remembering-the-bad-old-days-of-high-risk-pools/.

[xxiii] Sarah Lueck, “Adopting a State-Based Health Insurance Marketplace Poses Risks and Challenges,” Center on Budget and Policy Priorities, February 6, 2020, https://www.cbpp.org/research/health/adopting-a-state-based-health-insurance-marketplace-poses-risks-and-challenges