The COVID-19-induced crisis is reducing state revenue, while at the same time increasing the demand for public services. The final impact on Texans and the state economy is far from clear at this point. Despite Congressional action to increase federal assistance, the Texas Legislature will undoubtedly have to consider changes to the state/local tax system to support needed services.

The Texas tax code contains many outdated or wasteful exemptions that the Legislature has added over the years. Eliminating certain tax exemptions and updating some tax rates would go far to create new revenue for state services.

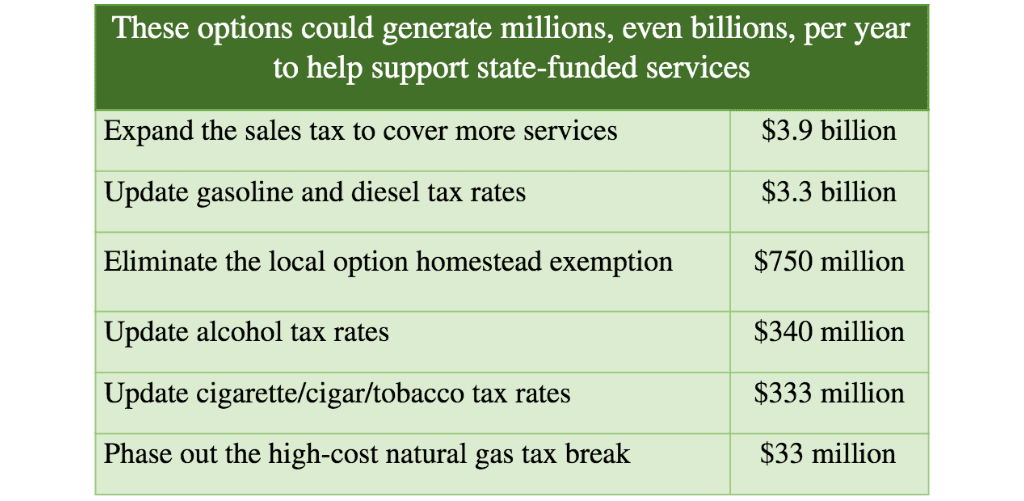

Sales tax: Expanding the sales tax base to cover services, like lawyers and accountants, could have generated $3.9 billion in 2019 alone. Adding targeted services to the sales tax base is more equitable than an across-the-board sales tax rate hike, as proposed in the 2019 session.

Gasoline and diesel tax rates: Cars have become much more efficient, meaning that people buy less fuel and therefore pay less in taxes. Raising motor fuels taxes to match inflation since 1991 – the last time these taxes were increased – could have generated another $3.3 billion in 2019. One-fourth, or $820 million, is constitutionally dedicated to schools. The remaining $2.5 billion would go to the Highway Fund. With gas prices at their lowest in years, now may be the best time to update motor fuels taxes.

Local option homestead exemption: School districts are allowed to grant a homestead exemption of up to 20 percent, in addition to the statewide mandatory flat-dollar exemption of $25,000. Most of the benefits go to wealthier Texans; only about 200 school districts in Texas make use of this provision. House Bill 3, the school finance bill passed in the 2019 legislative session, requires school districts to reduce their tax rate if property values grow more than a certain amount each year. But under the economic conditions expected for the near future, eliminating this unfair exemption would increase property tax revenue received by school districts, reducing the pressure on state aid.

Alcoholic beverage tax rates: The last increase in tax rates on beer, wine, and liquor was in 1984 when they were raised to help fund education reforms. Raising those alcoholic beverages’ tax rates to track inflation since 1984 could have increased state revenue in 2019 by $340 million.

Cigarette tax rates: The tax rate on cigarettes was last increased in 2007, also as part of a package of tax changes made to support school-finance reforms. The additional revenue from this change is deposited in the Property Tax Relief Fund, which in turn goes to the Foundation School Program. Adjusting the tax rate for inflation would have brought in another $333 million in 2019. Updating so-called “sin taxes” is one of the more popular options for raising revenue among many Texas voters.

High-cost natural gas tax break: Phasing out this tax break, which was instituted in 1989, would have generated $11 million for schools in the first year after taking effect, growing quickly to $35 million a year after five years, according to an estimate made in April 2019. The State Highway Fund and Economic Stabilization Fund would receive similar amounts.

These are all good options for raising revenue to maintain state support for public services. No single tax or revenue source is the silver bullet for addressing revenue shortages or the increased need for services. But by equitably updating the Tax Code across the board, the Legislature could prevent drastic budget cuts – cuts that would slow economic recovery, hurt Texans who are least able to withstand reduced services, and damage our long-term competitiveness in education and higher education.