How to Improve Texas’ Property Tax System

Senate Bills in the special sessions In his priority lists for both the first and second special sessions, Gov. Abbott included the topic of “property tax relief.” In response, the

Senate Bills in the special sessions In his priority lists for both the first and second special sessions, Gov. Abbott included the topic of “property tax relief.” In response, the

The House Ways & Means Committee will soon hear a very dangerous proposal – HB 59 by Rep. Andrew Murr – which would almost completely eliminate the school property tax that is

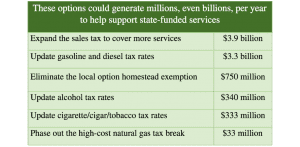

Our state’s tax system is upside down. Texas households that are least able to afford it pay the most in taxes as a percentage of their income, while the Texas

Property-Tax Circuit Breakers A property-tax circuit breaker reduces property taxes that exceed a certain percentage of someone’s income. Circuit breaker programs account for people’s ability to pay when calculating a

With resources limited, the focus should be on educational needs, not tax cuts The Texas House Ways and Means Committee, which controls bills related to the state’s revenue system, is

The 2019 Legislature made an important commitment to improving funding for our public schools. But the disruptions caused by COVID-19 have imposed unexpected new costs on our schools, as they

Public confidence in our property tax system depends on the perception that all taxpayers are treated fairly, and is the key to providing vital financial support for our schools and

The novel coronavirus has upended Texans’ lives and the state’s economy. We do not yet know what “normal” life will look like when this public health emergency has finally passed,

The COVID-19-induced crisis is reducing state revenue, while at the same time increasing the demand for public services. The final impact on Texans and the state economy is far from

Lawmakers Should Not Renew Tax Giveaways without Proper Review A gigantic program that lets companies get out of paying most school property taxes is scheduled to expire at the end