HB 570 — A Repackaged Wasteful Tax Giveaway

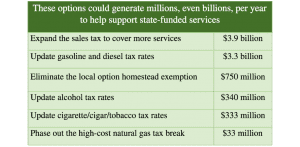

The state needs sufficient revenue to provide education, health care, transportation and other critical services for Texans. But this Wednesday, March 17, the House International Relations and Economic Development Committee