The House Committee on Appropriations approved its budget proposal on March 29, and a floor vote by the full House is set for April 6. The bill will, as usual, undergo some additional amendments on the House floor. Let’s explore some key Medicaid and Children’s Health Insurance Program (CHIP) provisions in the House Committee bill. After the House finalizes its budget proposal CPPP will post a comparison of the House and Senate budget proposals on Medicaid-CHIP policy and funding..

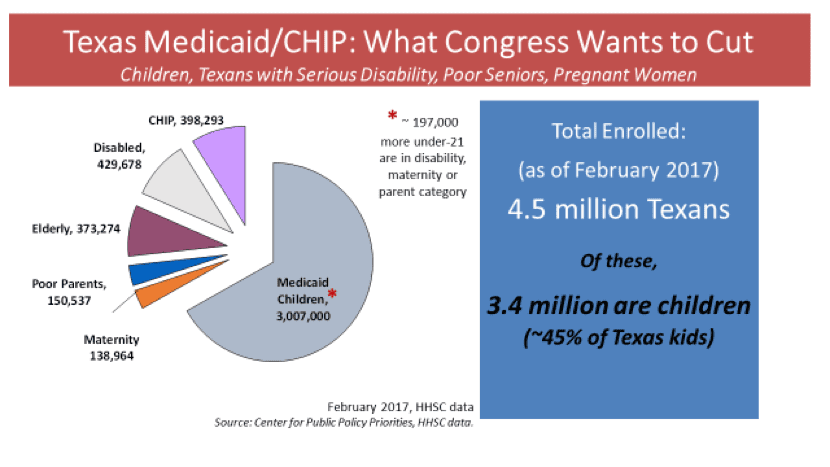

Key takeaway: some aspects of the House Committee‘s $63.2 billion All Funds proposal for Medicaid are positive, but other provisions raise serious worries about the security of medical and long-term care for millions of Texans.

As we have noted elsewhere, in this 2017 session it is especially critical to consider the supplemental appropriations bills for the current 2016-2017 budget period as part and parcel of the 2018-2019 budget plans. Without considering supplemental appropriations, any analysis of funding for state services and use of revenues will have major gaps.

As Eva DeLuna Castro noted in her post before the House Committee vote on its 2018-2019 bill, HB 2, the House’s supplemental bill for 2017, would use $931 million in General Revenue (GR) for Medicaid, which would also bring Texas $1.7 billion in federal matching funds. Combined, this $2.6 billion would ensure that Texas can pay the health care costs of about 4.1 million low-income Texans through the end of August 2017. This gap in funding is largely the result of 2015 budget writers’ choice to leave projected Medicaid cost inflation out of the 2016-17 appropriations act. HB 2 would also provide funding or transfer authority in fiscal year 2017 to undo half of the 2015 Legislature’s cuts to Medicaid acute care therapy services ($51.3 million in state and federal funds).

So under the House Committee’s budget plan, Medicaid makes it out of the current 2016-2017 budget period in fairly good shape. For 2018-2019, the House Committee’s bill funds enrollment growth in Medicaid, but does not fund the Health and Human Services Commission (HHSC) “Exceptional Item” request for cost growth in Medicaid (scored at over $1.75 billion GR early in session).

But the 2018-2019 House proposal also includes some large-scale provisions that create significant questions and concerns. In order of size, they are:

- HHSC Rider 36: Medicaid Funding Reduction and Cost Containment. Since 2011, each state budget bill has included a Medicaid Cost Containment rider directing reductions in spending and listing a number of policy options for cutting that spending. The House bill calls for cutting total 2018-2019 Medicaid spending by $111 million of GR ($244 million of All Funds), and lists 15 options for pursuing savings, plus authority for the agency to identify other approaches. The Senate’s bill has a version of this rider that cuts several times as much; stay tuned for that update.

- Article IX Rider 17.10: Contract Cost Containment. This lengthy rider in Article IX of the bill calls for $496.3 million in spending reductions attributed to sweeping changes in contracting practices across all agencies, but over 90 percent of the reduction ($450.2 million) is directed to HHSC. Contracting practices and irregularities have come under intense scrutiny in recent years, with recommended changes coming from the Legislative Budget Board staff report, a state auditor’s report on HealthSpring (a Medicaid Managed Care StarPlus contractor), an HHSC report to the legislature, and a House Appropriations subcommittee on budget transparency.

- HHSC Rider 186: Federal Flexibility. This rider directs HHSC to “pursue flexibility” from the federal government to reduce Texas Medicaid 2018-2019 spending by $1 billion GR ($2.4 billion All Funds). As worded in the House Appropriations Committee bill, the rider raises concerns that it could direct or allow very large program cuts. It simply directs HHSC to identify cost savings and report changes to Medicaid and CHIP to the LBB. Before taking a vote, committee Chairman Zerwas sought to reassure members that services would not be compromised. Amendments to better clarify the intent are expected to be offered on the House floor.

The three potential reductions to Medicaid spending listed above from the House Committee bill total $1.56 billion GR. Add to that the lack of funding for projected Medicaid cost growth which may approach $2 billion GR (and which the Senate has also neglected to fund in its budget), and we could be approaching—or exceeding—the scope of cuts adopted in 2003 and 2011.

Except for one thing. Only the HHSC Cost Containment rider 36 actually directs program cuts. As discussed in a recent blog on the Senate’s original filed budget, Texas has in a number of sessions over the last 20 years short-funded Medicaid to allow for a smaller balanced budget to be passed, but guaranteeing a substantial supplemental appropriation will be required in the next session to fund the final months of Medicaid (costs are currently running around $1.5 billion GR a month).

When budget writers do not direct the Medicaid agency to make a program, eligibility, or benefit cut to reduce spending to meet the state funding written into the budget, then the under-funding does not have to result in reduced eligibility or services for Texans on Medicaid. The Legislature can fill the gap in the next session. But they can only fill that gap if the state has the revenues available. Without revenues to fill these gaps, cuts could be forced, and fewer Texans in need of Medicaid will be covered, and/or the children, seniors, Texans with disabilities and pregnant women served today will get fewer health care services.

We hope that the final bill adopted by the full House will quell some of these fears. But as we wait for those actions, we remain deeply concerned about the large size of the Medicaid under-funding, and worried that the gaps may become cuts that are even deeper than the failed cuts of 2003.