Budget & Taxes

We're leading the fight for fiscal fairness.

For 40 years, Every Texan has been a leader in the two-front fight for fiscal fairness. We advocate for more equitable budget and tax policy and for greater investments in the services that all Texans rely on.

Texas is fortunate to have a thriving economy- the 8th largest in the world- driven by people across the state. Unfortunately, those building wealth in our state don’t share in the prosperity they create. The “Texas Miracle” is a mirage for millions. Year after year, our state’s spending on education, health care, strong jobs, and other social services remains stagnant. While Texas leaders celebrate our state as a business-friendly, low-tax state, billions of dollars are spent on corporate giveaways and the highest tax rates are piled on the shoulders of low-income Texans.

The State Budget

Texas Taxes

Local Budgets & Services

The state budget is a moral document.

For three years, Every Texan has worked with communities across the state to build the People’s Budget, a legislative road map that presents lawmakers with data-driven, community-informed solutions for Texan’s most pressing issues.

Let's create a state budget that invests in our communities and reflects our shared values.

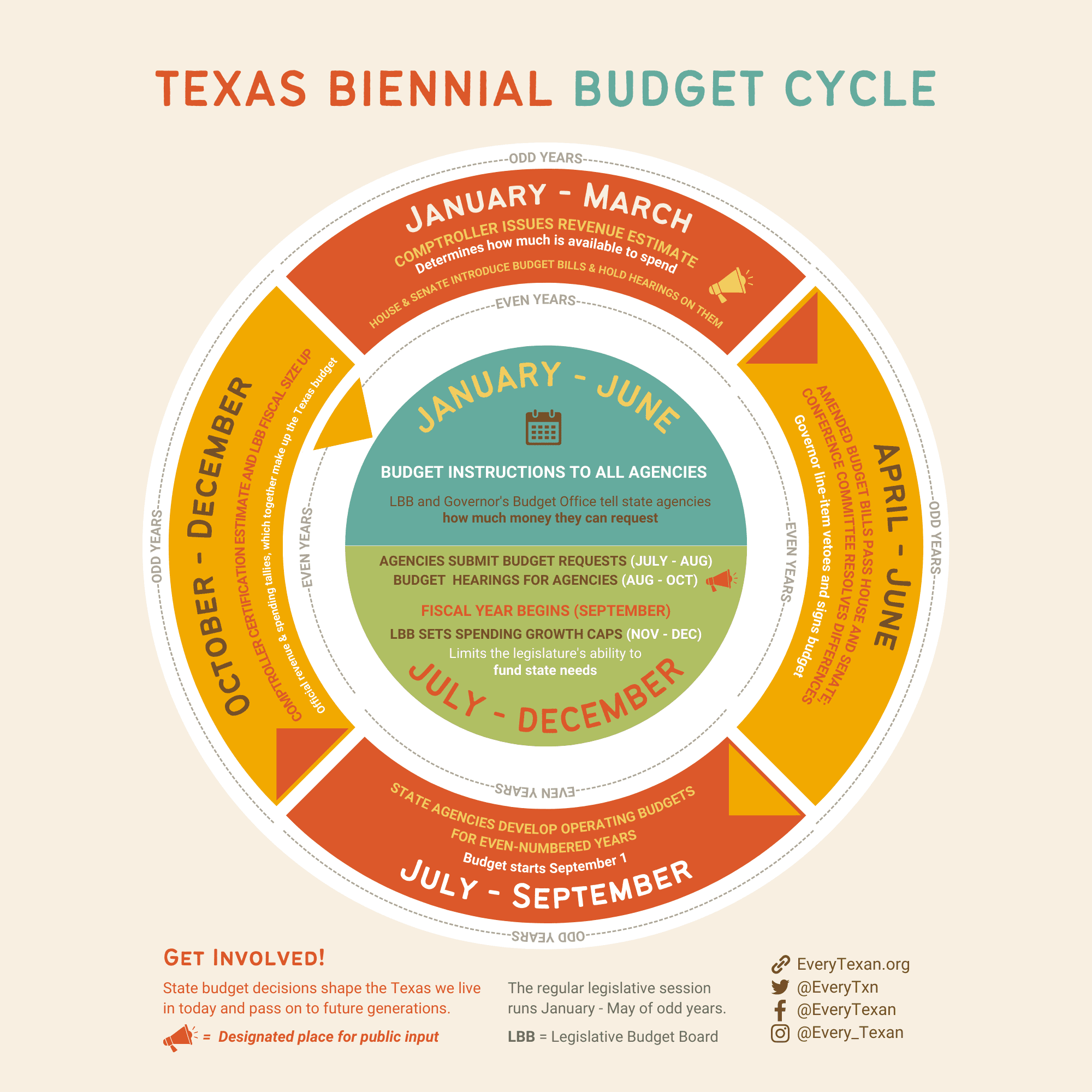

The Biennial Budget Cycle

The Texas budget process begins during the year prior to each regular session of the state’s Legislature, which are held in odd-numbered years. Each state agency prepares a detailed legislative appropriations request (LAR) under the guidelines of the state’s Legislative Budget Board (LBB).

State budget decisions shape the Texas we live in today and pass on to future generations. Be sure to get involved. Your voice matters!

Related Resources

Highest Tax Rates in the State Fall on Texans of Color

Austin’s Prop Q Would Provide Revenue for Essential City Services

What a Federal Government Shutdown Means for Texans

Testimony to House Ways and Means Committee Against SB 10 (89(2))

Testimony to Senate Finance Committee for SB 3

Testimony to Senate Local Government Committee Against SB 9

Your Support Makes a Difference

We believe Texas can be the best state in the United States, and our public policy work is an indispensable part of getting there. Your support improves equity in health care, food security, education, and financial stability.