Reforming Property Taxes Due to COVID-19’s New Reality

The novel coronavirus has upended Texans’ lives and the state’s economy. We do not yet know what “normal” life will look like when this public

The novel coronavirus has upended Texans’ lives and the state’s economy. We do not yet know what “normal” life will look like when this public

Making sure every Texan has the tools they need to come through this health and economic crisis must be the top priority of state lawmakers

The COVID-19-induced crisis is reducing state revenue, while at the same time increasing the demand for public services. The final impact on Texans and the

The COVID-19 outbreak has reminded us that any one person’s well-being depends on everyone else’s. Texans must work together to help those bearing a disproportionate brunt of

Texans are about to start hearing more about a state income tax. Here’s why. During the most recent state legislative session in Austin, lawmakers passed

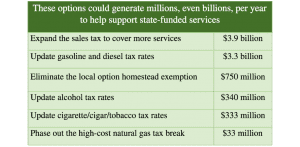

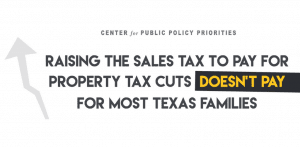

In early April, Governor Abbott, Lieutenant Governor Patrick and Speaker Bonnen announced that they will support a proposal to raise sales taxes to limit property

Educating 5.4 million Texas public school students is a critically important responsibility. All of us benefit directly or indirectly from public education, and it’s our

Lawmakers Should Not Renew Tax Giveaways without Proper Review A gigantic program that lets companies get out of paying most school property taxes is scheduled

The Texas Senate may soon vote on SB 2, a misguided proposal that would limit the ability of cities and counties to decide how much

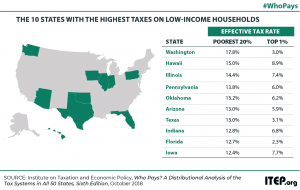

We hear plenty from elected leaders about Texas being a “low-tax state,” but we are actually a high-tax state for many families. By setting up