Who Pays Texas Taxes?

Download this report as a PDF For the state to invest in the building blocks of thriving communities — schools, health care, public safety, roads, parks, and other public services

Download this report as a PDF For the state to invest in the building blocks of thriving communities — schools, health care, public safety, roads, parks, and other public services

The COVID-19-induced crisis is reducing state revenue, while at the same time increasing the demand for public services. The final impact on Texans and the state economy is far from

Lawmakers Should Not Renew Tax Giveaways without Proper Review A gigantic program that lets companies get out of paying most school property taxes is scheduled to expire at the end

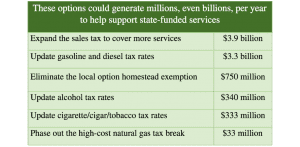

You would think that, having just written proposed state budgets that would underfund or cut health care, financial aid, and more, the Texas Legislature would want to avoid similar tight

Public attention is currently focused on the large tax-cut bills that both the House and the Senate passed, in different forms. The House plan, which would reduce the rates of

The House and Senate have different tax cut proposals, generating many questions about what these tax cuts could mean for the future of Texas. Here are some answers to frequently

A just-released Institute on Taxation and Economic Policy report estimates that undocumented immigrants in Texas collectively paid $1.5 billion in property, sales, and excise taxes in 2012. (For other states

Last week’s release of the 2015 Tax Exemption and Tax Incidence report by the Comptroller’s office is great reminder that Texas tax system is in dire need of a little spring-cleaning.

The price of oil, which was over $100 per barrel last summer, has lately been selling at half that amount. Drilling new wells has slowed down, so we’re left to

Senator Rodney Ellis proposed new legislation Tuesday to close a state loophole that allows commercial property owners to skirt their responsibility and significantly reduce their property tax bills below the