Testimony against HB 1556 in House Ways & Means Committee

A substantial drain on future state resources may continue to be the program of school property tax abatements known as “Chapter 313,” after its section in the Tax Code. This

A substantial drain on future state resources may continue to be the program of school property tax abatements known as “Chapter 313,” after its section in the Tax Code. This

On March 1, 2021, Senior Fiscal Analyst Dick Lavine testified before the Texas House Ways and Means Committee. Lavine highlighted the costs of state tax giveaways and exemptions and offered

The 2019 Legislature made an important commitment to improving funding for our public schools. But the disruptions caused by COVID-19 have imposed unexpected new costs on our schools, as teachers

The COVID-19-induced crisis is reducing state revenue, while at the same time increasing the demand for public services. The final impact on Texans and the state economy is far from

Texas is responsible for the education of 5.3 million school children. Money matters in education, and we need a funding system that meets the needs of our large and diverse

Lawmakers Should Not Renew Tax Giveaways without Proper Review A gigantic program that lets companies get out of paying most school property taxes is scheduled to expire at the end

Money matters in education, and it’s good to see proposals at the Texas Capitol to boost support to the 5.4 million public school students in our state. Governor Abbott declared

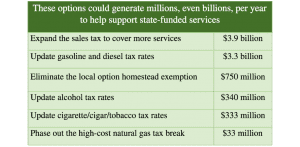

The Texas public school finance system is due for some renovations. And we need raw material to get the job done. As the Texas Public School Finance Commission debates changes

Like the House’s tax proposal, the U.S. Senate plan released this week would give hundreds of billions of dollars in tax cuts to wealthy households and major corporations at the

Why talk about the 2020-21 Texas state budget when lawmakers are still deciding the 2018-19 budget? It’s because the decisions our state leaders make now will have dramatic effects on