Instead of focusing on increasing the basic allotment for schools, the primary per-student funding amount, the Legislature set its sights on defunding public education with costly tax cuts. When the House and the Senate couldn’t agree on how to make these cuts during the regular session, the Governor called them back for an immediate special session with a demand for tax rate compression. In quick order, the House passed a tax compression bill and then adjourned. The Senate, on the other hand, added a homestead exemption to their bill. Both chambers refuse to hear the other chamber’s bill, creating a stalemate that could result in another special session.

What is tax compression?

Tax compression reduces the property tax rate for everyone – homeowners, businesses, and out-of-state investors that hold property in Texas. It’s called “compression” because school funding is formula-based, meaning schools receive the same amount of funding regardless of where the tax rates are set. Tax compression swaps local property taxes for state dollars; our schools see no benefit from this.

Tax rate compression is concerning because state leadership is trying to eliminate the main funding source for our schools without establishing a new revenue source to replace those funds. This means there will not be resources in the future to increase the basic allotment or adjust it annually for inflation. The basic allotment has not changed since 2019; as a result, our schools are experiencing cuts each year because the funding is not rising with costs. Eventually, without a new source of revenue, tax rate compression could lead to further cuts to education spending. A deep dive into tax compression can be found here.

What is a homestead exemption?

The homestead exemption reduces the taxable value of a home for Texans that live in their homes. The current homestead exemption is $40,000. If you live in a home valued at $250,000, you would only be taxed at a value of $210,000. Like tax compression, the state must make up for the local school funding lost.

Who benefits from tax compression vs homestead exemptions?

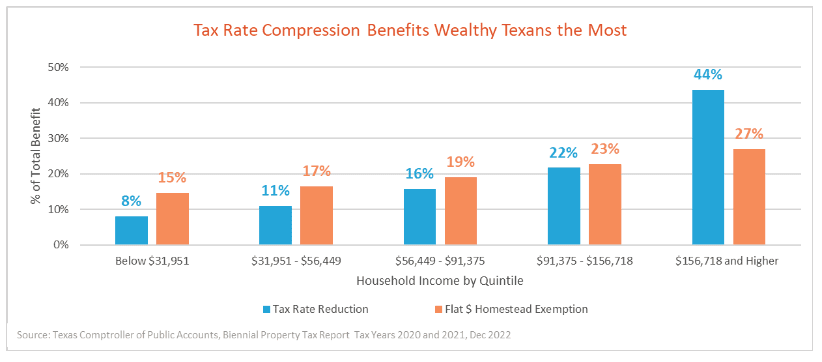

While the Legislature should focus on improving school funding before making property tax cuts, the homestead exemption is the more equitable option. Homestead exemptions target Texans living in their homes rather than businesses, out-of-state entities, and investors. Renters do not benefit from either approach since the tax savings from compression are not required to be passed down to renters.

Homestead exemptions are more equitable because the benefit is proportional to the value of the home receiving the exemption since it is a flat dollar amount. Wealthy Texans benefit the most from tax rate compression because they are more likely to own a home than lower-income Texans, and those homes tend to be of higher value.

The House vs. The Senate

HB 1 – Tax Rate Compression

- Reduces the main school property tax rate for schools by $0.162 per $100 of property value.

- Cost: $12.36 billion for the 2024-25 biennium.

SB 1 – Tax Rate Compression and Homestead Exemption

- Reduces the main school property tax rate for schools by $0.10 per $100 of property value.

- Increases the homestead exemption to $100,000 from $40,000

- The homestead exemption increase requires the passage of a constitutional amendment to go into effect (SJR 1).

- Cost: $12.134 billion for the 2024-25 biennium.