View this testimony as a PDF here.

Texans of all backgrounds value public education and strive to unlock its promises of opportunity and shared prosperity. To ensure every child in Texas, from Dallas to Brownsville, has access to a high quality education, the Legislature must make sustained investments in our public schools. The budget is a declaration of values, and the base budget introduced by this committee clearly prioritizes tax cuts over investments in the school children of Texas.

HB 1, as introduced, uses the historic $32.7 billion beginning fund balance to appropriate $15 billion in property tax cuts, and nothing for our schools except a vague statement of intent to increase school funding. The best ways to improve school funding is to increase the basic allotment and adopt enrollment based funding.

Increasing the Basic Allotment

When the basic allotment is increased, 30% of a school district’s budgetary increase must go to compensation. Of that amount, 75% must go to teachers, librarians, counselors, and nurses – with priority given to teachers with 5+ years of experience.

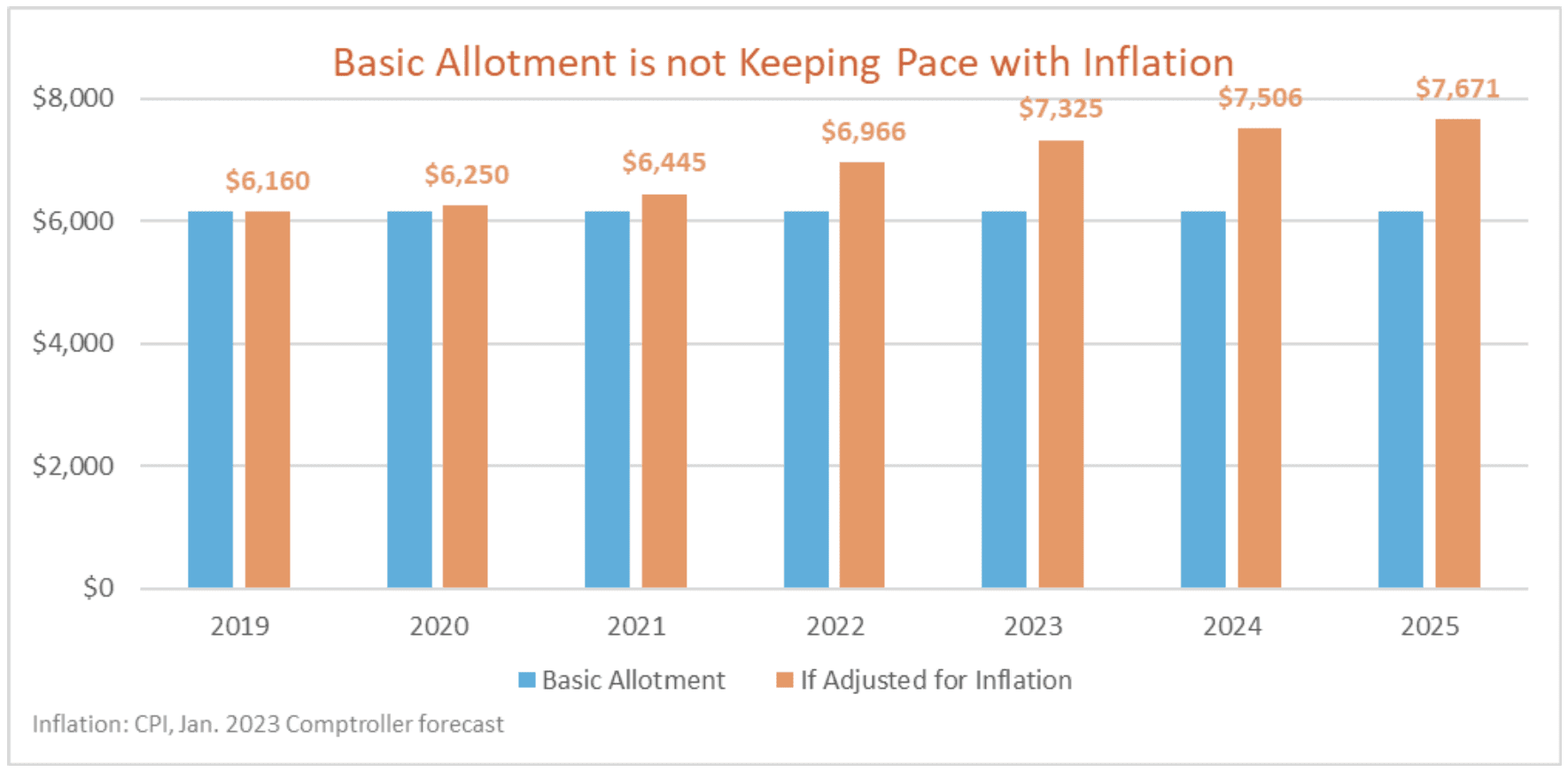

The basic allotment, an amount of funding per student, is the primary building block of the school finance formulas and is set arbitrarily by the Legislature. No identifiable costs are used to determine the basic allotment, nor is it adjusted annually for inflation. The Legislature has left the basic allotment stagnant at $6,160 per student for the last four years. By not regularly increasing the basic allotment, the Legislature has denied Texas public schools the ability to improve compensation for teachers being impacted by record levels of inflation.

If the basic allotment was adjusted for inflation annually since it was last set in 2019, it would be $7,325 for this school year. For the 2024-25 budget, the basic allotment would need to be $7,506 for 2024 and $7,671 for 2025. At the end of the biennium the basic allotment would be $1,511 per student higher than it is today.

The House Appropriations Committee is able to increase the basic allotment in HB 1, Article III Texas Education Agency Rider 3 without separate legislation, but chose not to in the first draft of the budget. Instead this committee prioritized property tax cuts.

Enrollment-Based Funding

Education is the bedrock of an informed society and the bridge to self-sufficiency. Every parent in Texas, from Texarkana to Brownsville, regardless of their race or circumstance, wants their child to have access to a high-quality education. Most parents assume schools receive enough funding to support their child’s education.

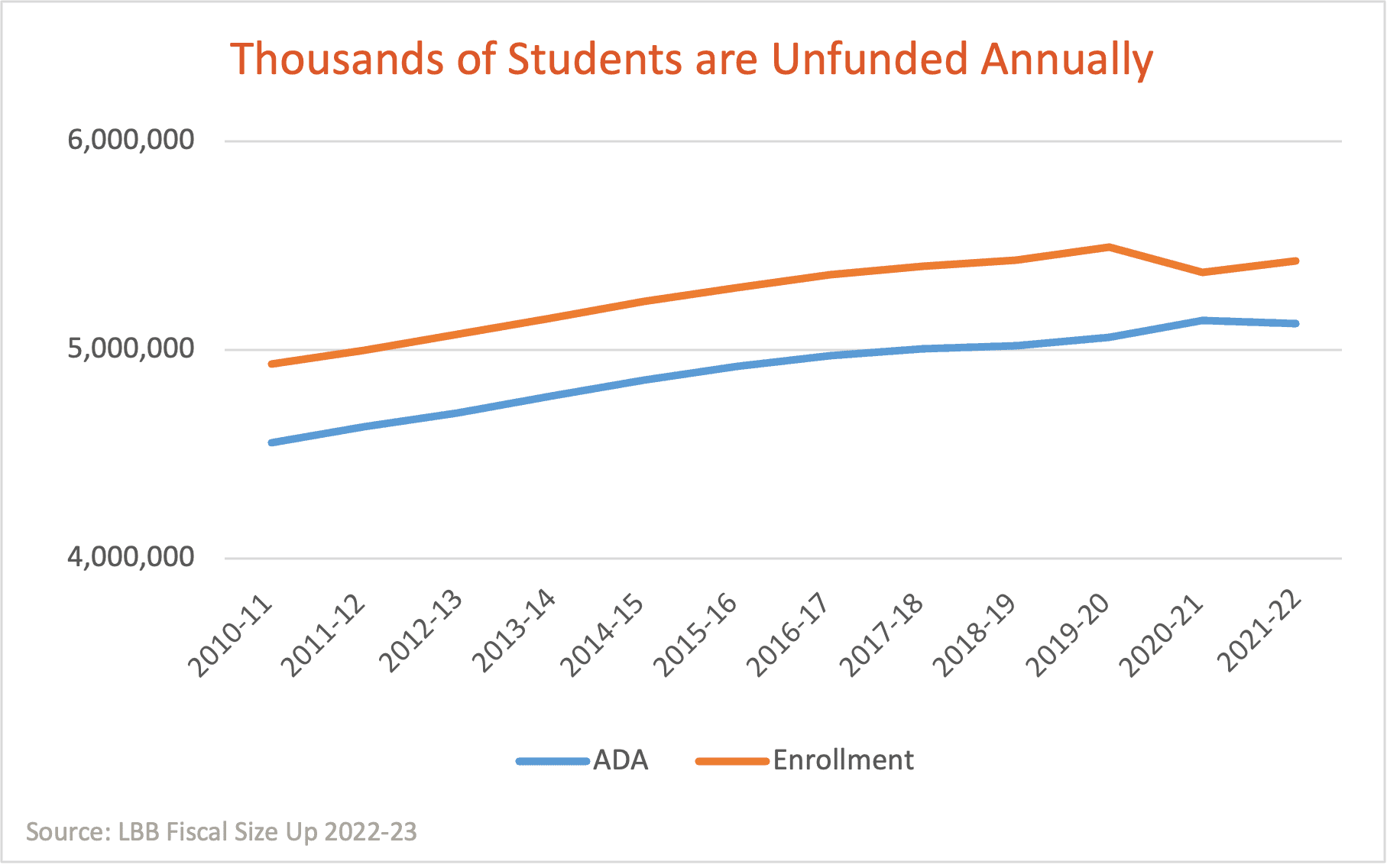

Unfortunately, the Texas school finance system left nearly 300,000 students uncounted in the 2021-22 school year. In the first year of the pandemic, 8% of kids, or nearly 433,000 students, were uncounted — even after the Texas Education Agency (TEA) made adjustments due to COVID-19 attendance loss. For perspective, that’s nearly the entire school population of Arkansas.

Undercounts happen because Texas continues to use an archaic method to fund our schools. Instead of using enrollment — the number of actual students served — our state determines funding based on attendance. Currently, only six states use attendance-based funding (CA, ID, KY, MS, MO, TX).

Not a lot of research shows that tying funding to attendance improves attendance. However, studies do show that attendance is higher when schools create a positive experience and have good relationships with caring adults. Schools can strengthen attendance by promoting parent engagement and collaborating with community-based organizations that focus on the social, emotional, and financial wellbeing of students and their families.

Attendance and chronic absenteeism should be addressed in the Closing the Gap domain of the A-F accountability system. This way, schools and districts would report and be held accountable for absentee rates of subgroups of students. Tying funding to attendance hurts schools that need resources the most.

Every student, regardless of where they live or their specific needs, should be accounted for in school funding. With the state reporting record levels of cash on hand, it’s time to put kids first and count every student.

Tax Compression Does Not Benefit Our Schools

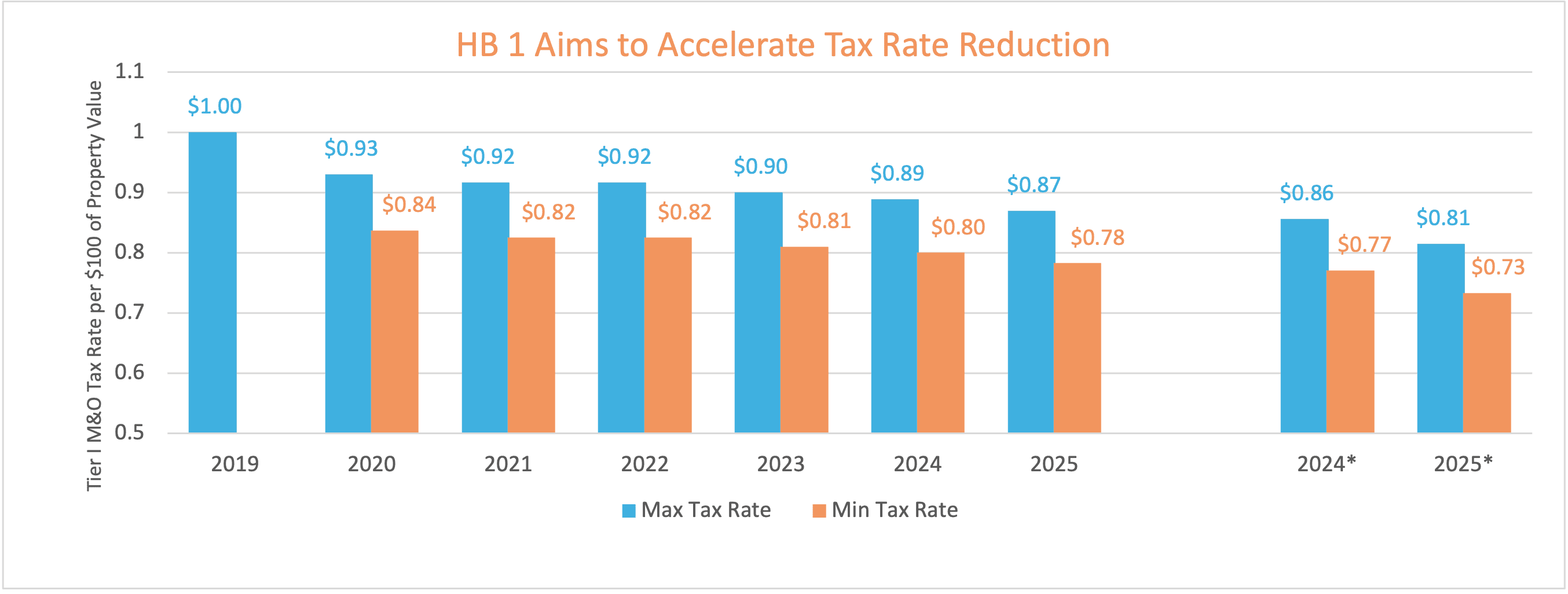

Due to HB 3 (R-2019), the Tier I M&O tax rate declines each year when statewide property value growth is above 2.5%. Districts are also forced to reduce their rates individually if they experience growth above the estimated statewide average (or 2.5% if the statewide average is below that threshold). HB 1 estimates the cost of HB 3 compression at $3.118 billion for the 2024-25 biennium. This committee proposes adding another $2.156 billion to this compression by increasing the statewide value growth percentage to 7.75%.

HB 3 prioritized tax cuts over kids by creating a glide path towards elimination of the Tier I M&O tax rate instead of adjusting the basic allotment annually for inflation. HB 1, as introduced, aims to accelerate the elimination of the primary tax used to support schools while leaving the basic allotment unchanged.

In addition to the $5.274 billion appropriated for tax rate compression, HB 1 includes another $9.726 billion to cut property taxes even further, for a total of $15 billion in tax cuts.

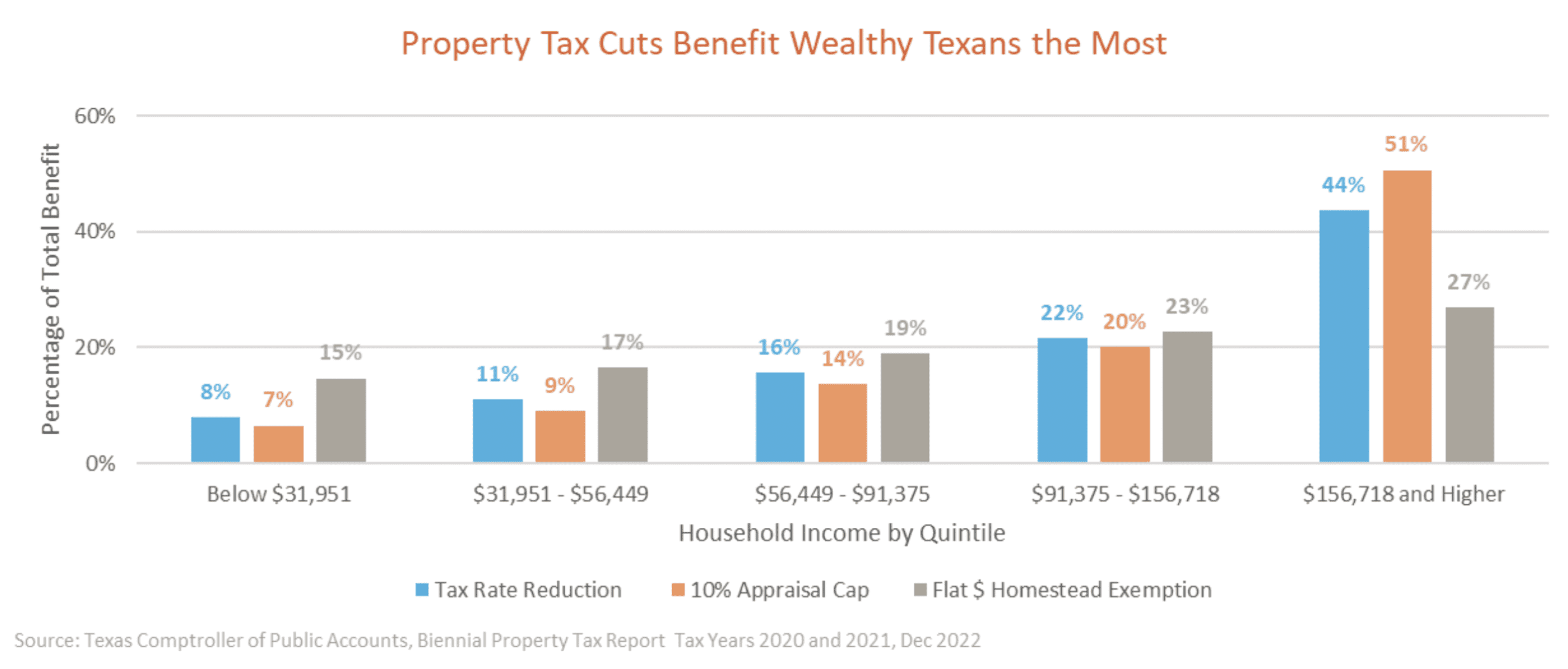

Property tax cuts benefit wealthy Texans the most. Households with higher incomes pay the most in property taxes, so when the Legislature makes cuts to property taxes those households see the greatest benefit. Texans with lower incomes tend to own less expensive homes or pay property taxes through rent. There is no guarantee that rents will decline when property taxes are cut.

For every $1 billion spent on tax rate reduction (compression) or increasing the appraisal cap, households in the wealthiest quintile experience a substantially disproportionate benefit compared to households in the bottom quintile. Flat dollar homestead exemptions are more equitable, providing only a slight advantage to higher income households.

With the historic $32.7 billion beginning balance the Legislature should seize this opportunity to make meaningful investment in public education before exploring options for tax cuts.

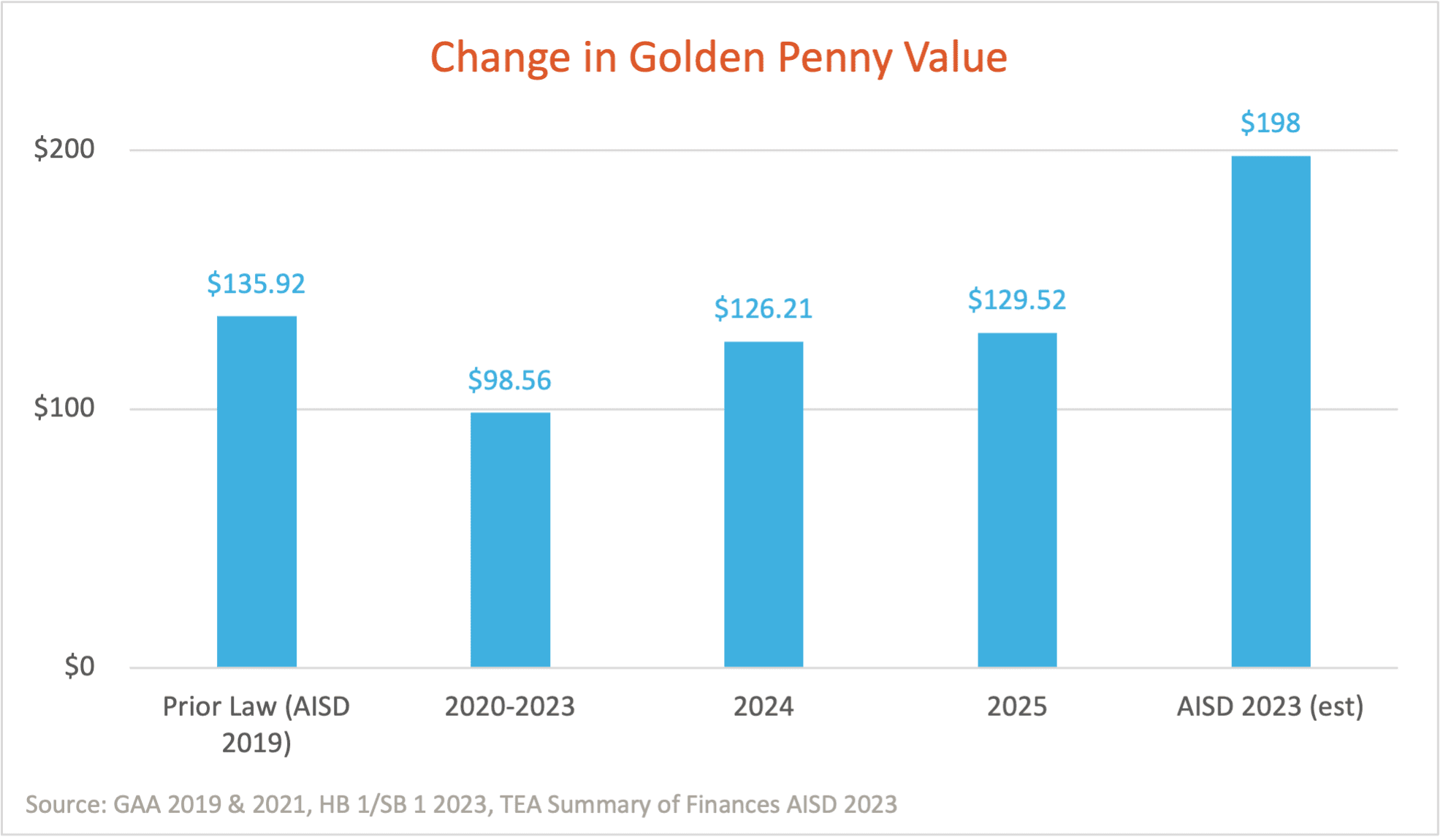

Golden Pennies Lag Behind Pre-HB 3 Level

Due to property value growth, the value of “golden pennies” increases to $126.21 for 2024 and $129.52 for 2025. While this is good news for the districts equalized up to this amount, the value of the golden pennies remains lower than it was before the passage of HB 3.

Prior to HB 3, the value of golden pennies was tied to Austin ISD’s yield. Since values in Austin increase each year the value of those pennies increased each year for districts receiving equalization.

HB 3 decoupled the golden pennies from Austin ISD and set their value at 160% of the basic allotment or the 96th percentile of wealth. This brought the value of the golden penny down to $98.56 from $135.92. The golden pennies remained at $98.56 from 2020-23 because the Legislature did not increase the basic allotment and the yield for districts at the 96th percentile did surpass that amount. The value of the golden pennies was stagnant for four years, when before their value increased annually.

Now that property values have increased greatly, the value of the golden penny is increasing as well. However, if the golden pennies were still tied to Austin ISD they would be worth an estimated $198 today and even more for 2024 and 2025.