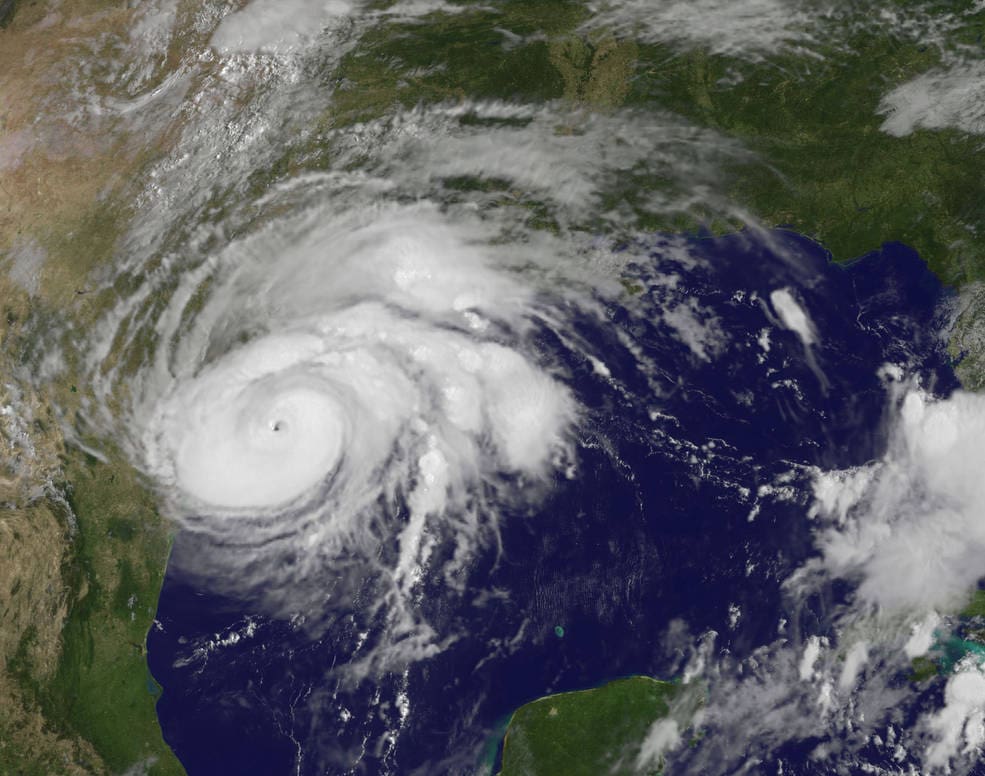

In response to Hurricane Harvey, the Texas Department of Insurance (TDI) released four health insurance-related “bulletins,” or formal communications to insurance companies with requests and instructions. (TDI also released several additional bulletins focused on property insurance. All Harvey-related bulletins from TDI can be found here.)

The purpose of the bulletins is to help ensure that limitations and restrictions in state-regulated health insurance plans do not prevent consumers affected by the disaster from getting needed health care services, supplies, medications. The bulletins convey the opinion of TDI that affected consumers in Texas during the disaster period should:

- Have coverage for out-of-network care, both emergency and non-emergency. Bulletin B-0012-17 requests that health plans “waive penalties and restrictions” and “not deny payment” for needed care, including non-emergency care, obtained out-of-network due to the disaster.

- Be able to access needed care without jumping through the standard hoops. Bulletin B-0012-17 requests that health plans waive requirements for consumers to get prior authorization of health care, review of requested services for medical necessity, and referrals from a primary care physician to other providers. Is also asks health plans to waive requirements that patients notify the plan of a hospital admission.

- Be able to access needed prescription medications, even if the prescription was recently filled. Bulletin B-0014-17 requests that health plans authorize payments to pharmacies for up to a 90-day supply of prescription medications without regard to when the prescription was most recently filled. It is common for health plans to deny prescription refills until a consumer’s existing medication supply is almost depleted, but after a disaster, that type of limit could prevent people from replacing needed medications lost or left behind during an evacuation or damaged by the storm.

- Be able to access needed medical equipment and supplies, regardless of when the equipment and supplies were most recently provided. Bulletin B-0010-17 requests that health plans authorize payment for needed medical equipment and supplies, regardless of when the supplies were most recently provided. As above, this will ensure that people can get needed medical equipment replaced.

- Be offered some flexibility around premium payments to help consumers maintain continuous coverage. Bulletin B-0009-17 requests that health plans and other insurers work with affected consumers to provide some flexibility around the timing of premium payments to help affected consumers maintain continuous coverage. The bulletin does not dictate an approach, but mentions grace periods, suspending (but not forgiving) premium payments, and offering payment plans.

*Note that Texas Medicaid, CHIP, and Medicare have also put policies in place to ensure that standard restrictions that prevent prescription refills from being made “too soon” do not prevent people affected by Hurricane Harvey from getting needed medications. Medicare has also waived restrictions related to out-of-network providers and gatekeeper referrals. CPPP has linked to all Harvey-related agency guidance for Medicaid, CHIP, and Medicare here.

What can consumers affected by Hurricane Harvey do if they can’t get needed health care related to the scenarios above?

First, call your insurance company (and take this step even if you think your specific barrier to care is not covered in TDI’s bulletins). Explain how you’ve been affected by the disaster and ask that the health plan make accommodations for you to get needed health care.

If that doesn’t work, consumers with plans regulated by TDI can call the TDI Consumer Help Line at 1-800-252-3439 or file a complaint online. TDI does NOT oversee all types of health insurance. TDI only has oversight of the health insurance plans held by about 1 in 3 Texans with private insurance. If you have the letters “TDI” or “DOI” printed on your insurance ID card, TDI oversees your health insurance plan and can step in to help ensure you can get needed care.

If your insurance card does not have “TDI” or “DOI” printed on it, you should reach out to your insurer to try to get help, and check with your employer’s plan administrator/Human Resources department. Many insurance companies have indicated that they will waive prescription refill limits, prior authorization requirements, etc. broadly, even for plans not subject to TDI oversight.