Community colleges and public two-year colleges are vital higher educational institutions; they provide students with the courses they need to achieve workforce certification, associate degrees, introductory courses before transferring to a four-year college, and recertification courses. From the start of the 88th Legislative Session, Texas was uniquely positioned to make significant improvements to the state’s community college funding model and build a system more responsive to the needs of the students they serve.

Although public two-year colleges are often overlooked in the legislature, this session, community college finance was a well-supported priority by our state representatives, higher education coalitions, students, and Texas’ 50 community college districts. As a result, during the second week of June, the Governor signed HB 8 – the community college finance bill.

While HB 8 does not have dollar amounts written into it, $650 million has been budgeted for the next two years to meet the legislation’s goals. HB 8 provides a new funding structure and creates several new programs for community colleges. However, the amount and impact of the new system will heavily depend on what the coordinating board establishes during rulemaking.

HB 8 Addresses Previous Inequities

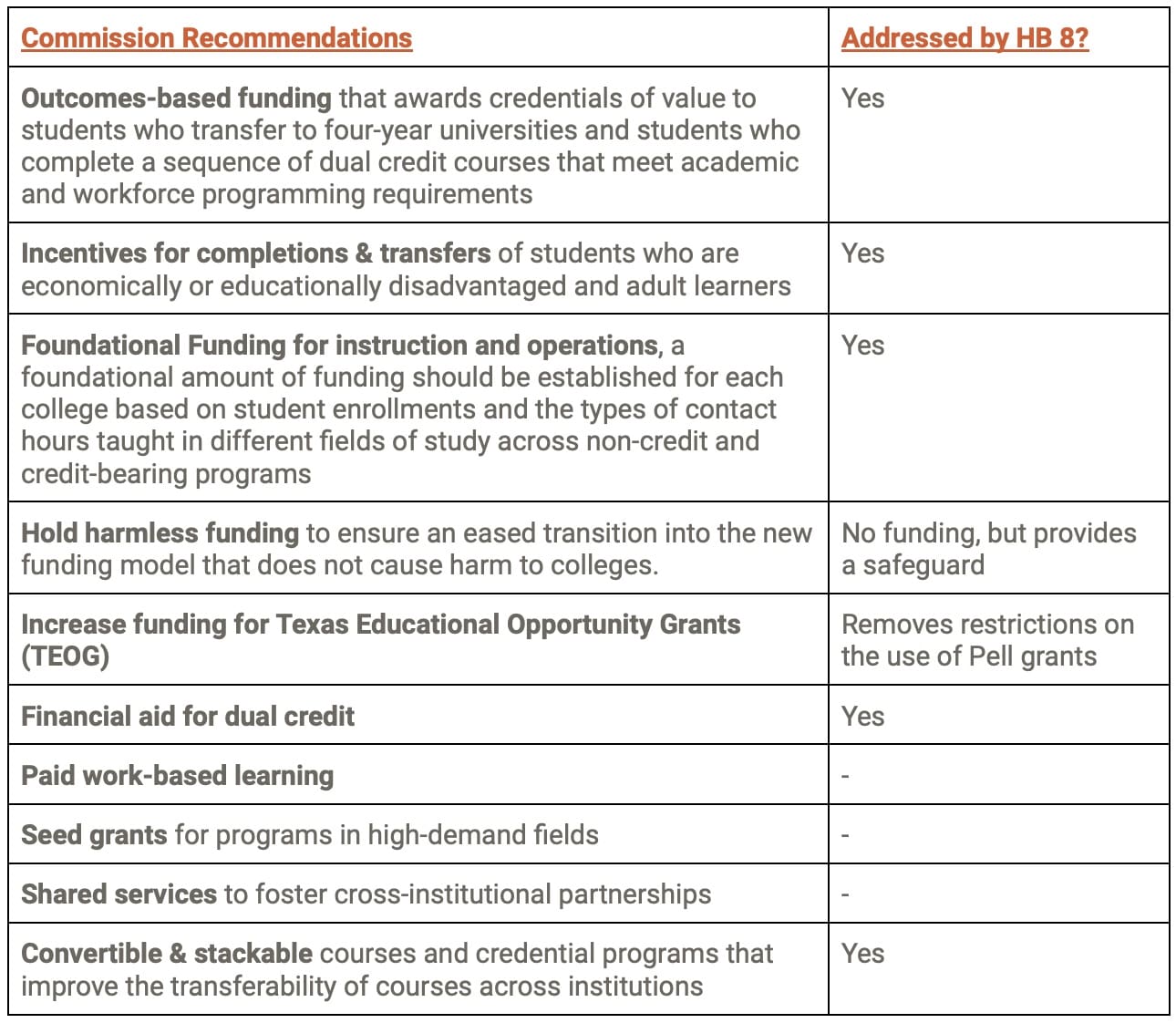

Before HB 8 community colleges received most of their money through a formula that relied overwhelmingly on contact hours and success points. However, contact hours did not accurately account for or cover enrollment costs, and success points were unfair to colleges serving first-generation students, economically or academically disadvantaged students, and students over the age of 24, many of whom may require additional resources to meet the goals outlined in the success point model. To address these issues, the Community College Finance Commission (CCFC) provided recommendations available here, along with more information about the previous funding model and missed opportunities.

What’s in HB 8?

Increased Transparency

HB 8 created new programs that reflect recommendations by the Commission for Community College (CCC) to increase transparency around the value and cost of educational programs. The final version of HB 8 is an accumulation of language and amendments from seven other bills: SB 2294, SB 1887, SB 2029, SB 2139, SB2422/HB4437, HB 4722, and SB 2068.

HB 8 also requires additional information about the value and cost of educational programs for prospective postsecondary students. Specifically, the bill requests that information is provided so that students can compare programs across different institutions. That information includes:

- Starting salaries and educational requirements for the top 25 “highest demand jobs”

- Cost, value, median wage, average debt-to-income ratio, completion rate, etc.

- The identification of 40 baccalaureate degree programs and 20 associate degree or certificate programs with the highest average annual wages after graduation.

New Programs

Financial Aid for Swift Transfer (FAST): FAST allows students classified as “educationally disadvantaged” to enroll at no cost to them in a dual credit course. Colleges are allowed to participate if the amount of the dual credit course does not exceed the amount prescribed by the coordinating board.

- This means that colleges are not required to participate in the programs. Potential inequities may arise with this program depending on which colleges decide to participate and how information is shared with high school students.

Texas Direct Associate Degree: Texas Direct serves a state-wide effort to make “seamless degree pathways between two- and four-year institutions.” Currently, there are five fields of study as a part of the program: business administration, criminal justice, political science, social work, and sociology.

- This means that when students complete their required curriculum or coursework at a public two-year institution, they will receive an associate degree and the courses are transferable.

Opportunity High School Diploma Program: This diploma program allows for a public junior college to award a high school diploma for students who are enrolled in a workforce education program through a series of educational activities that prepares students for postsecondary education or additional workforce education. Colleges that decide to participate in the program are entitled to receive funding from the state.

New “Modern & Dynamic” Funding Structure

The new base level for the HB8 structure consists of state and local funding and accounts for instructional costs, operational costs, and district contact hours. The base tier funding has weights to adjust for colleges educating students who are:

- 25 years of age or older,

- Economically disadvantaged,

- Academically disadvantaged, and

- Small colleges that serve fewer than 5,000 full-time students.

The legislature decides how much institutions will receive for each student based on the weighted adjustments above. The coordinating board then determines the total amount of contact hour funding each college gets. HB 8 also includes language that states that contact hours and semester credit hours for a course taken by a student for the third time will not count towards the funding formula. The local share of the funding is made up of district taxes and an assessment of tuition and fees.

State funding is based on student performance that aligns with the local and state workforce needs, based on the following:

- Credentials of value awarded – which is determined by the coordinating board based on wages and the cost of meeting the educational requirements for the job.

- An additional weight is added for the placement of students who earn the credential in a high-demand occupation.

- Students earning at least 15 semester credit hours;

- Transfers to a four-year college;

- Enrolled in a co-enrollment program; and

- Students who complete a sequence of at least 15 credit hours or equivalent dual credit courses that apply toward academic or workforce program requirements.