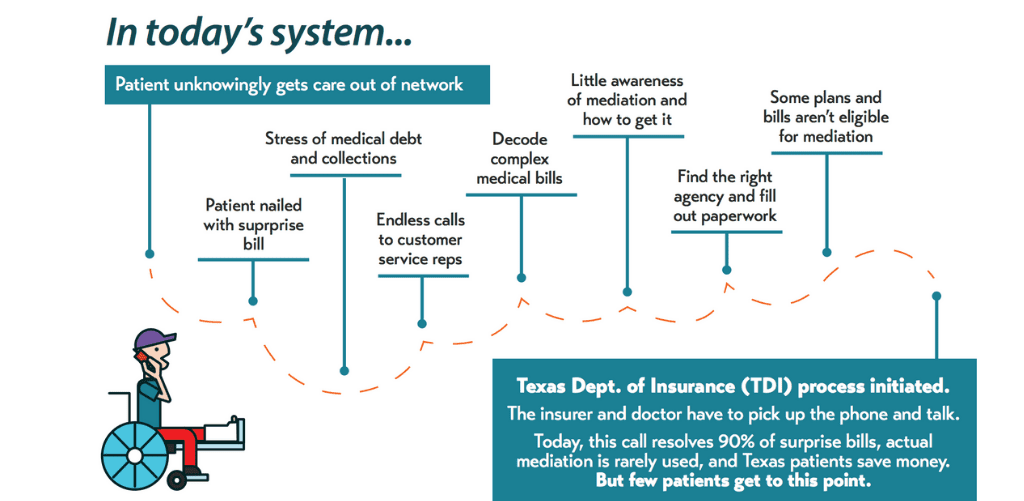

When patients can’t choose their health care providers, like in emergencies, they may unknowingly get care that is out of network. A surprise medical bill often follows. Surprise medical bills happen when insurers and doctors or other health care providers – in a fight over prices – jointly pass the buck to a patient.

Texas set up a process for some patients to challenge certain surprise bills ten years ago. Unfortunately, today’s system to address surprise bills simply doesn’t work for most patients.

- Patients face the stress and fear associated with medical debt and collections,

- There is little awareness of the state’s surprise medical bill mediation system and how to access it,

- Patients must decode complex medical bills, find the right agency, and fill out paperwork,

- Some plans and bills aren’t eligible for mediation, and

- As a result, only a small share of Texas patients who could use mediation make it through the wringer.

Four bills have been introduced this session that will end surprise out-of-network bills for consumers with health insurance plans regulated by the state (as opposed to plans regulated at the federal level, which is often the case for large employer plans): SB 1264 by Sen. Kelly Hancock, HB 3933 by Rep. Trey Martinez Fischer, HB 2967 by Rep. Tom Oliverson, and SB 1591 by Sen. John Whitmire. Each of these bills would:

- End surprise bills from out-of-network providers when patients did not get to pick their providers, like in emergencies. In these cases, patients will only be billed for their in-network copay or deductible.

- Provide a dispute resolution system for health care providers and insurers. Doctors and insurers will still fight about prices, of course. These bills provide a venue to resolve those disputes without patients being trapped in the middle of the fight.

- Apply equally to all types of state-regulated insurance plans, including PPOs, HMOs, and EPOs – so that more consumers are protected.

In addition, SB 1264 and HB 3933 fix the problem in a manner that helps constrain health care cost growth and encourages strong provider networks. These are key consumer protections. Policymakers are still debating what, if any, payment standard—upper or lower limits—to put into state law. This debate directly affects what consumers pay for health care.

One option is pegging payments rates to the amounts that providers charge. Billed charges are like the maximum room rate posted on the back of the hotel room door: inflated rates no one really pays. Pegging payments to these non-market prices would increase health care costs and premiums paid by consumers. Ending surprise billing but pegging payments to charges will swap one problem for consumers with another.

There are several far more reasonable benchmarks for payment standards. For example, a recent report by the USC-Brookings Schaeffer Initiative for Health Policy recommends pegging payments to the average mark-up over Medicare payment rates that is used in negotiated commercial insurance rates for most types of physician specialists. This works out to about 125 percent of the Medicare rate on average, though the ratio would vary by market.

Congress is also currently discussing ways to end surprise medical bills. This is critical because most Texans with job-based health insurance actually have a plan that’s regulated at the federal level. We need Congress to act to fully protect consumers with these plans, but states can still help. There are 4 bills filed at the Texas capitol that would allow employers with federally regulated plans to opt-in to state surprise medical billing protections. These good bills include: SB 1530 by Sen. Kelly Hancock and HB 3299 by Rep. Eddie Lucio III, as well as SB 1264 and HB 3933 mentioned above. At CPPP, we are grateful to see so many Texas leaders and stakeholders working on this important issue. We think 2019 is the year to finish the job in Texas and end surprise medical bills!