Here are our top 6 insights

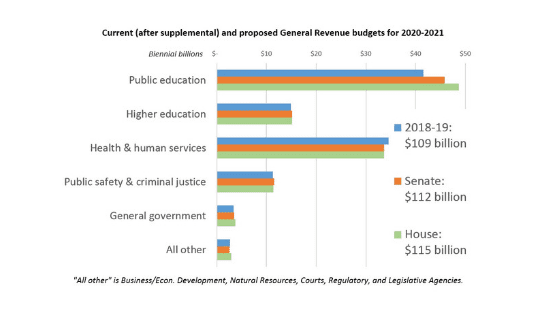

The Texas Senate and House of Representatives have each released their 2020-2021 draft budgets, SB 1 and HB 1 respectively. What are the potential impacts on health care, education and other essential programs and services? It’s encouraging to see both chambers’ proposed budgets are not as far apart as they have been in the recent past. The House proposes a state budget of $115 billion in General Revenue for 2020-2021, which is about a six percent increase over 2018-2019. The Senate proposes a state budget that uses $112 billion in General Revenue for 2020-2021. But these numbers only tell part of the story.

- It’s encouraging to see both chambers’ proposed budgets are not as far apart as they have been in the recent past. The House proposes a state budget of $115 billion in General Revenue for 2020-2021, which is about a six percent increase over 2018-2019. The Senate proposes a state budget that uses $112 billion in General Revenue for 2020-2021. But these numbers only tell part of the story.

- The House proposes to use $633 million of the Economic Stabilization Fund (Rainy Day Fund) in 2020-2021 with a third of it going to retired teachers’ health care. The Senate proposes using $2.5 billion of the Fund, including at least $1.2 billion for Hurricane Harvey costs in 2019, and $711 million for 2020-2021 budget items. CPPP supports these responsible uses of the Economic Stabilization Fund, especially when the Comptroller predicts the Fund will grow to unprecedented levels while the state still has serious financial needs.

- We are pleased to see $7.4 billion more in General Revenue dedicated to public education in the House proposal, but this is NOT necessarily a massive windfall of new money for schools. Much of the new state aid for schools that the House proposes may be earmarked for pushing down local taxes. That could change the balance between the state versus local share of school funding, but without real increases in total funding per Texas student. In the Senate, budget writers propose an across-the-board pay raise for public school teachers, who certainly deserve more compensation. However, we ’re concerned the current proposal will provide greater benefits to the districts already able to offer low student-teacher ratios. A teacher compensation plan that focuses on the greatest need would serve the state better in the short and long term.

- Both chambers propose enough funding to cover caseload growth for Medicaid, but budget writers assume average costs stay the same as they are in 2019. Budget writers do not sufficiently account for the increase in health care costs (like rising prescription drug prices, for example). This is a recurring approach to funding Texas Medicaid, which will mean that lawmakers would have to once again pass a substantial supplemental budget for health care costs in 2021, just to finish out the two-year budget cycle.

- Both the House and Senate leave a significant amount of General Revenue “on the table” that lawmakers could use as the budget moves through the committee process. Lawmakers can use all of this untapped General Revenue without exceeding the spending growth cap adopted by the Legislative Budget Board on January 11, 2019.

- Whether “All Funds” (which includes federal money) or General Revenue, total spending in both budgets is insufficient to keep up with projected population and inflation by 2021. Lawmakers will eventually deal with some of this shortfall when the 2021 legislature approves supplemental funding for Medicaid (see #4 above). Some of that unfunded cost growth, however, may show up in the form of rising public college tuition or local communities increasingly paying for essential services that the state budget doesn’t cover.

CPPP will continue crunching the numbers and analyzing the impact of the budget proposals on core Texas services. We look forward to working with leaders to build state and local revenue and budgeting systems that meet Texans’ needs.